In a search for attractively priced, income-producing equities, investors will usually research the companies that have a proven, long track record of growing distributions. As a result, dividend aristocrats, the stocks that can display a track record of at least 25 years of consecutive dividend increases may provide multiple investable opportunities for income-oriented investors.

However, despite the financial resiliency and prolonged periods of commitment to shareholder returns, blindly investing in dividend aristocrats is not necessarily a wise choice. Some of them may keep on increasing their dividends, despite being financially distressed, like Exxon Mobil (XOM), which could potentially not end well. Others may display rapidly-growing financials and prospects, like Ecolab (ECL). Still, their premium valuation may not make them the most suitable pick for income investors, considering their low yield.

Today, however, we believe that one of the dividend aristocrats offers a balanced investment case featuring a decent dividend, a reasonable valuation, and modest growth prospects. That is, Archer-Daniels-Midland (NYSE:ADM).

In this article, we will:

- Discuss the company's financials and some factors related to its business model.

- Assess the stock's valuation, dividend growth, and overall return potential.

- Conclude why shares could be a great fit in income-oriented portfolios.

Financials and business model

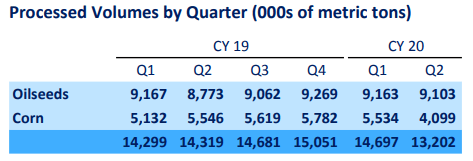

Archer-Daniels-Midland's businesses involve the processing of cereal grains and oilseeds, as well as the storage and transportation of various agricultural and related products. Because oilseeds and corn are extremely important for the needs of households, restaurants, and the food industry in general, their demand is very stable without adverse fluctuations over the years. With the exception of minor production corn issues in Q2, the company's processed volumes remain primarily solid on a quarterly basis.

Source: Investor presentation

As a result of trading agricultural products, which are subject to fluctuating commodity prices, the company's financials are directly affected by such