Thesis

DocuSign (NASDAQ:DOCU) operates in the digital signing market, which has surprisingly been bigger than expected. This beachhead allows DocuSign to expand across the life cycle of documents in a way that is being underappreciated by the market. Further, disciplined execution and the recent dip in share price present a compelling short-term investment opportunity in a well-run company.

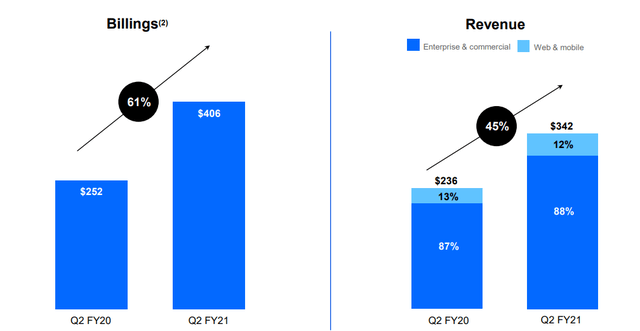

Source: DocuSign

Financial Performance

Recent Q2 '20 performance showed slight acceleration due to COVID-19. Although I would not consider DocuSign a secular COVID winner, I do think it is a beneficiary and the customers it gets will be stickier than some of the other platform plays. This is due to the nature of document signing in large organizations, where products can get entrenched. We saw this with Adobe (ADBE) and will see it with DocuSign.

In the recent quarter, DocuSign posted slight acceleration and beats to estimates that I believe will be a tailwind for the company for several quarters as the nature of work remains more remote than before the pandemic.

Source: DocuSign

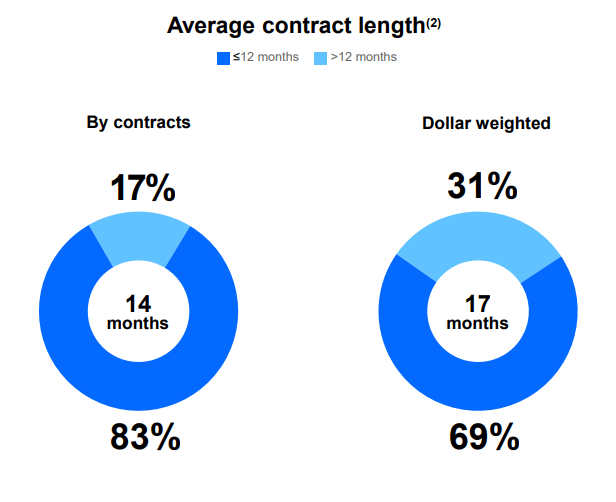

Further, DocuSign's move into the enterprise gives more visibility to its revenue base, which naturally deserves a multiple premium. A contract duration of 14 months is significant.

Source: DocuSign

Growth Vectors

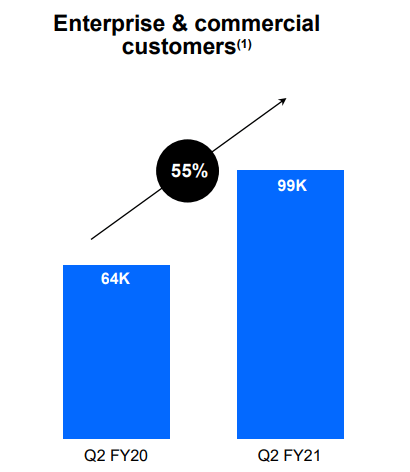

The real story is in the enterprise customer growth count at 55%. I believe this is still an untapped market opportunity with upsell potential that can help DocuSign monetize its add-on M&A.

HelloSign and OneSpan (OSPN) are competitors in the market, but DocuSign is the best capitalized with the biggest brand recognition. I believe these are actually durable moats, and DocuSign can acquire innovative tools and technology to further build its technology moat.

Source: DocuSign

DocuSign is already moving to expand its existing accounts in the enterprise by building out its enterprise feature set. Below, we can see some