This series is an extension of my regular, trading-day "Technically Speaking" series. Here, I assume that broad-category ETFs are the investor's primary investment vehicle. The column is devoted to intermediate-term (3-6 months) trades and longer.

Investment thesis: the following ETFs are on the buy list: SPY, IJH, IWM, IWC, XLP, XLV, XLC, XLK. Please see below for a further explanation.

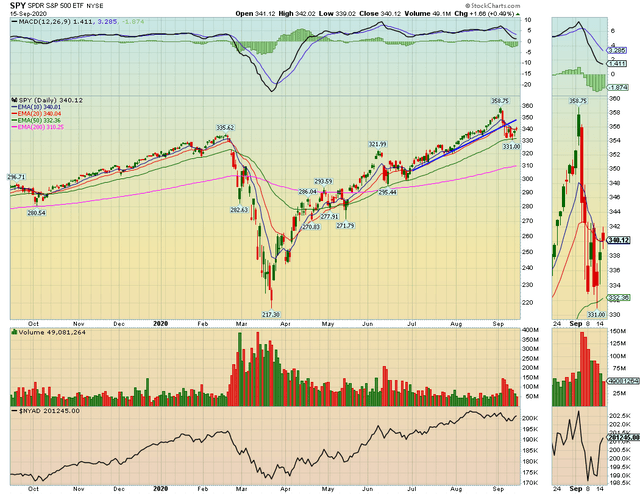

SPY

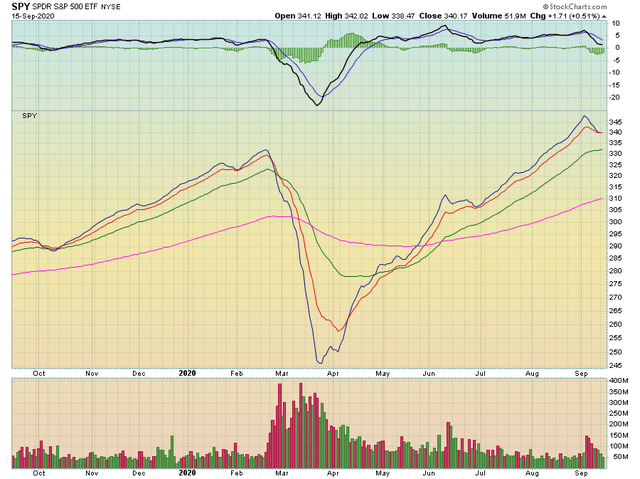

SPY is still attractive as a core portfolio holding based on these two charts:

Although SPY broke its trend from the summer, prices have fallen back to the 50-day EMA and it is consolidating losses. The decline in volume indicates that the selling has probably slowed for now.

While the shorter EMAs are moving lower, the longer-term EMAs are still rising, indicating the long-term trend is still higher.

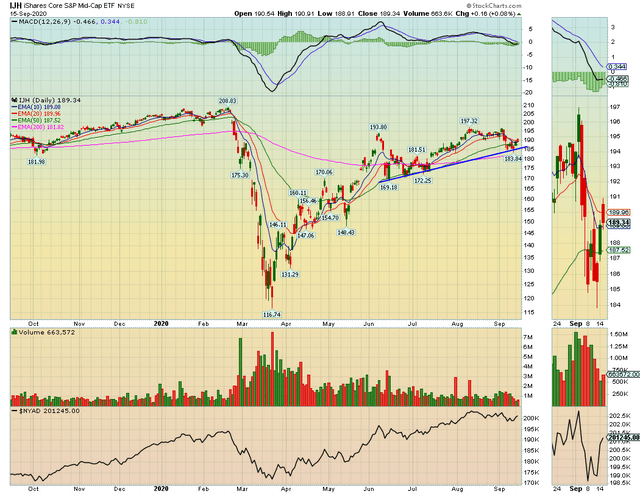

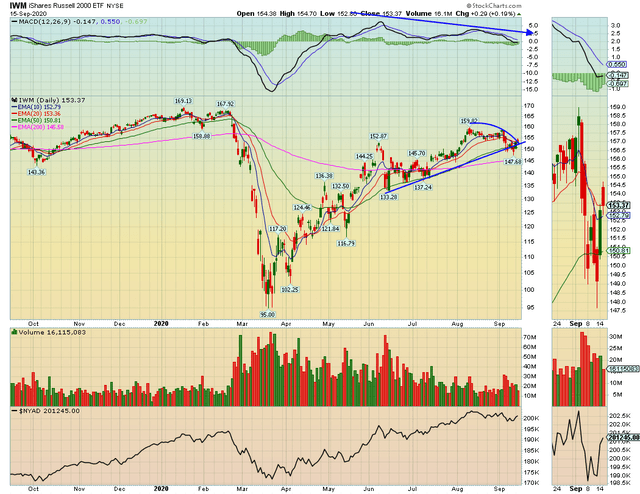

The smaller-cap equity indexes are all still in uptrends:

Mid-caps recently fell back to their trend line before bouncing modestly higher. Momentum has moved lower, but that hasn't translated into meaningfully lower prices. The longer-term EMAs are still moving higher.

Small caps have the same pattern - short-term weakness, but a still-intact longer-term trend.

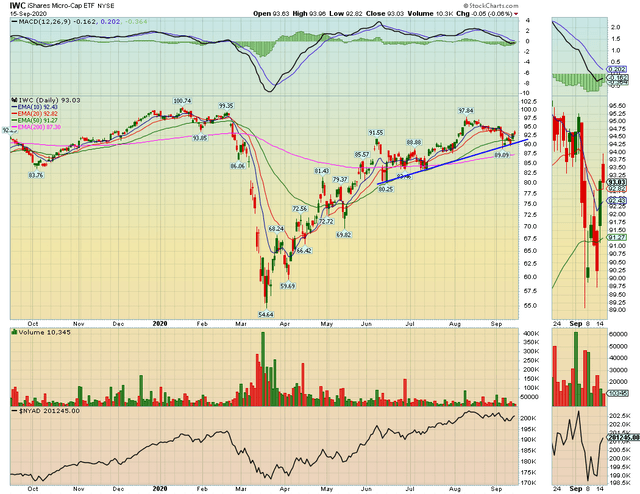

Micro caps recently had a stronger bounce than either IJH or IWM.

For investors that want a "set it and forget it" portfolio, the SPY/TLT combination should suffice. The following table shows how this portfolio performs with various allocations:

Data from Finviz. The left number is the SPY percentage, while the right number is the TLT percentage. Green is a positive return; red is a negative return.

Look towards the lower right and notice that all portfolios have performed well during the last 6 and 12 months, and then consider that in relation to the high volatility in the equity market. For investors with a higher risk tolerance, substitute an index using smaller-cap stocks such as IJH, IWM, or IWC.