Welltower (NYSE:WELL) is a large and well-recognized Healthcare REIT that had a 25+ year history of paying uninterrupted dividends prior to the pandemic. However, COVID-19, coupled with oversupply concerns, proved too much for the company to handle, as the dividend was reduced by 30% back in April.

Since reaching its 52-week low of $24.27 back in March, the stock has made a strong recovery to the current price today. In this article, I evaluate whether if the stock presents an attractive investment opportunity today; so let’s get started.

(Source: Company website)

A Look Into Welltower

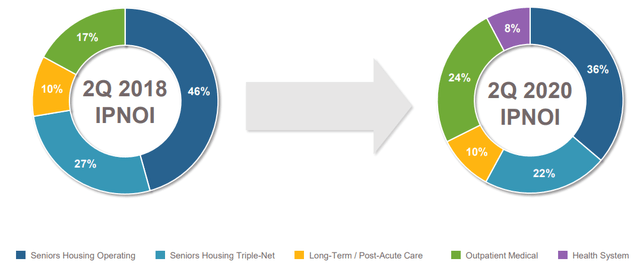

Welltower is a leading Healthcare REIT with a focus on owning and acquiring seniors housing, post-acute care (including skilled nursing facilities), and medical office buildings (MOB). The company was originally formed in 1970 with just two skilled nursing facilities. Today, it owns approximately 1,300 senior living communities, and 23M square feet of medical office buildings. Last year, Welltower generated over $5B in total revenue. As of the latest quarter, Welltower’s two largest segments are seniors housing and MOBs, which represent 58% and 24% of the company’s in-place NOI, respectively.

(Source: September Investor Presentation)

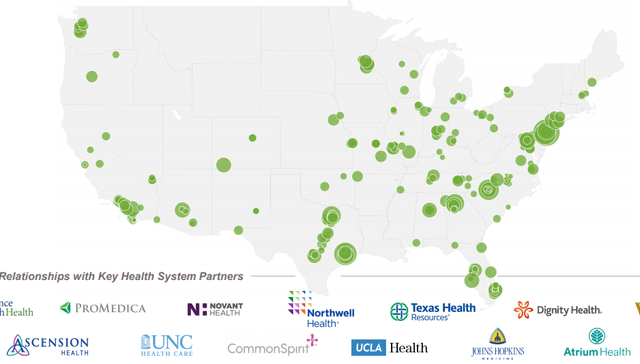

One of the more promising areas for Welltower is its medical office segment, which has continued to see growth, with a same-store growth rate of 1.8% YoY in the latest quarter. This sector benefits from both the secular trend of a growing senior population and the trend of increased utilization of outpatient care. According to data from the American Hospital Association, outpatient facilities have seen a 54% increase in visits from 1999 – 2019, while inpatient admissions increased by just 6% over the same time period. As seen below, Welltower’s MOB portfolio has relationships with leading health systems, and is well-diversified by geography.

(Source: September Investor Presentation)

The seniors housing segment has