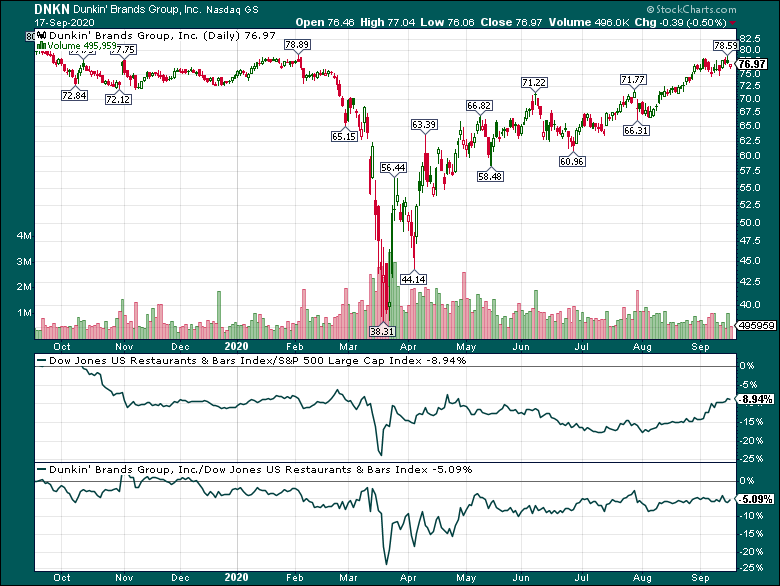

Restaurant stocks were brutally punished early on in the pandemic-driven selling this year. That’s with good reason, as many of them were closed for extended periods of time. However, the group has been resilient since the first round of panic selling, and has outperformed the market since the bottom.

Dunkin’ Brands (DNKN) has been a beneficiary of this, and shares trade today at nearly the same level they were before the panic hit.

The stock has performed in line with its peer group, more or less, and that has been good enough for Dunkin’ to round trip its prior losses earlier this year. Normally, I’d want to find a stock that had outperformed its peer group, but in this case, Dunkin’ has enough going for it fundamentally that the above relative strength is good enough.

A long runway for growth

Dunkin’ has experienced explosive unit growth in the past decade or so, but with its franchise-only model, dollar-basis revenue improvements can look underwhelming. Still, it has been plenty good enough to produce strong earnings growth.

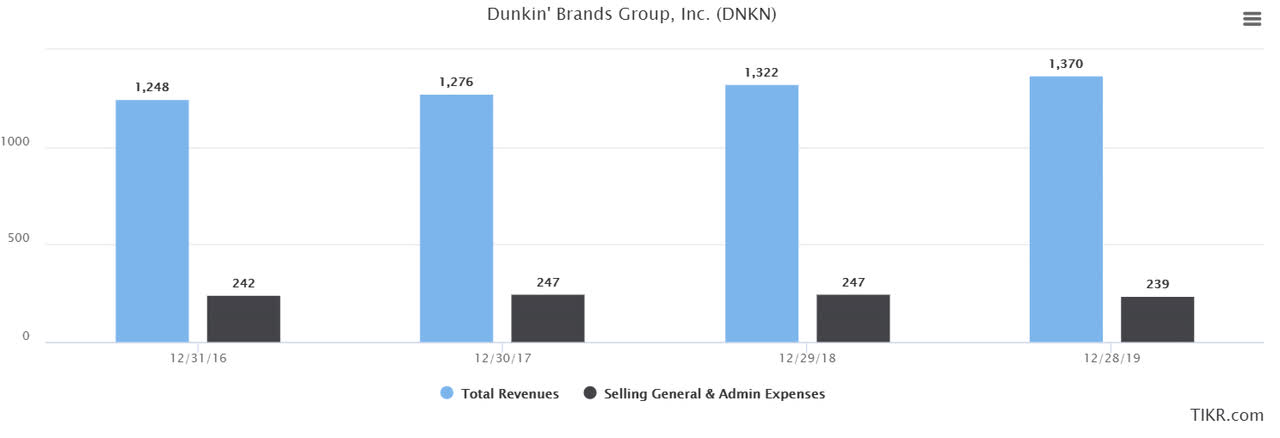

Source: TIKR.com

The reason is because Dunkin’s model affords it significant operating leverage. One of the perks of a franchise-only model is that operating costs can be kept roughly constant, irrespective of how big the store base is. That’s exactly what we see above.

Revenue has moved steadily higher in the past few years, while SG&A costs last year were actually lower than they have been for the prior three years. That means that each incremental dollar of revenue contributes an incrementally greater proportion to operating margin, which is exactly what Dunkin’ has been doing for years.

Source: TIKR.com

EBIT margin has risen steadily in recent years because of the SG&A leverage the company has achieved. Given that it continues to grow the store base and