Introduction

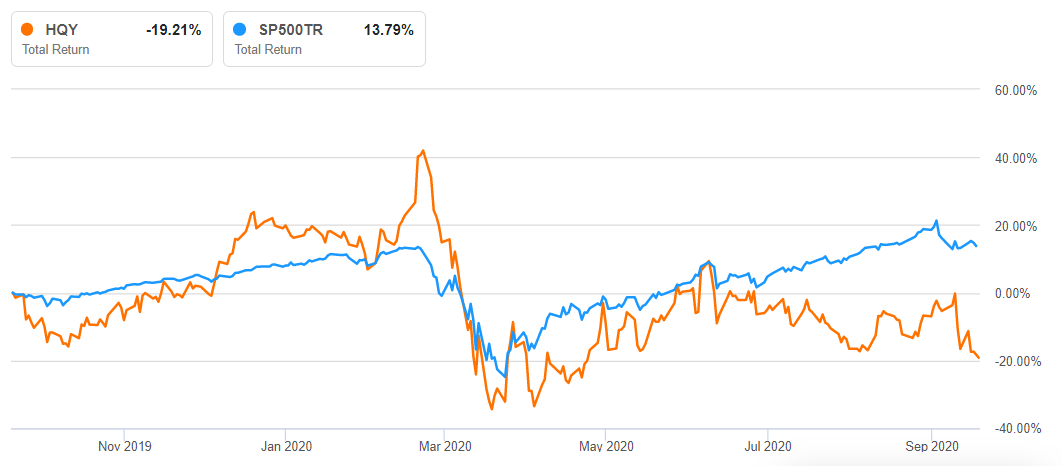

HealthEquity (NASDAQ:HQY) noticeably under-performed the S&P 500 in the past year, with much of the pandemic-related losses not yet recovered. This article discusses the company’s performance in 2020 along with research data on the HSA market to explain the long runway ahead for the HSA sector.

Source: Seeking Alpha

Background

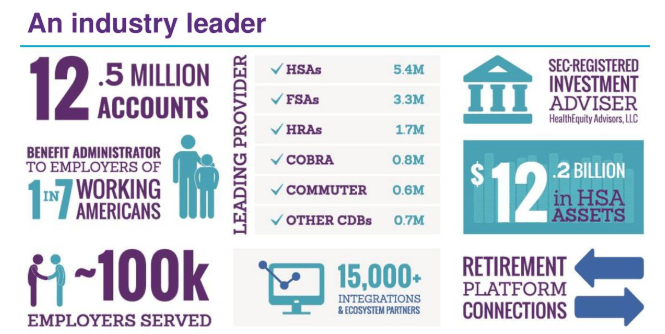

HealthEquity is a leading provider of technology-enabled platforms that enable consumers to make healthcare saving and spending decisions. HealthEquity’s platforms are used to manage tax-advantaged health savings accounts (HSA) and other consumer-directed benefits (CBD) offered by employers, including flexible spending accounts and health reimbursement arrangements (FSA and HRA), Consolidated Omnibus Budget Reconciliation Act (COBRA) administration, commuter and other benefits.

Source: Investor Presentation

Synergies of the Acquisition

HealthEquity completed the acquisition of WageWorks a year ago and is in the process of realizing synergies of the acquisition. During the Q2 conference call, management reported to have completed migrations of 5,000 clients, 700,000 members, and 1.2 billion of HSA assets with 96% of service fees retained. Recurring net synergies achieved as of the end of fiscal Q2 surpassed $50 million, a goal that was expected to be achieved only by the end of 2021. As a result, management is raising the guidance for net synergies to an additional $30 million, expected to be realized in the next 18 months.

Performance in 2020

Service revenue: Derived from account and management fees. Q2 service revenue was $103.8 million (295% year-over-year growth).

Custodial Revenue: These are derived in two ways:

- Interest on custodial deposits

- Record-keeping fees, calculated as a percentage of custodial investments.

Q2 custodial revenue was $46.9 million (8% YoY growth)

In the below sections, data from HealthEquity as well as HSA market data will show rising percentage of invested assets over time. In 2015, 13% of the total HSA balance was invested. It is expected