It’s been more than three months since I last wrote about Booz Allen Hamilton (NYSE:BAH), and since then, the shares have done well. Since the publication date of June 6th, the shares have posted a total return (including dividends) of 8.3%, exceeding the 2.5% return of the S&P 500 over the same time period.

While this run-up in share price has made the stock more expensive, I believe there is still some room for continued upside, and in this article, will show why.

(Source: Bizjournals)

Booz Allen Hamilton is a leading global consultancy firm with over 26,000 employees. It has a mix of both public and private sector clients operating in, among others, civil government, defense, intelligence, energy, financial services. Over its 100+ year history, Booz Allen Hamilton has consulted on high profile projects with clients including the Navy and NASA, and last year, the firm generated nearly $7.5B in total revenue. BAH has adjusted well to the current COVID-19 operating environment, as management noted that currently, 80% of its billable work is being done remotely.

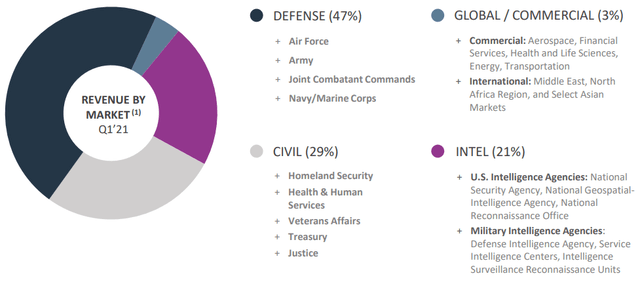

What I like about BAH is the mission-critical services that it renders for key governmental agencies. As seen below, 97% of its revenues in the last quarter were related to the Defense, Intelligence, and Civil sectors. Its low 3% exposure to global and commercial clients means that BAH is less susceptible to economic cycles, thereby making it a recession-resistant enterprise.

(Source: August Investor Presentation)

While having most of its business being tied to the federal government comes with advantages, it also comes with risks, as changes in federal appropriations can have a negative impact on BAH’s revenue streams. This risk, among others, was highlighted by management during the latest conference call:

At this point, the unknowns in the back half of the year remain. First, we do