It’s been nearly four months since I last wrote a favorable article about CareTrust REIT (NYSE:CTRE), and since then, the shares have posted a total return (including dividends) of -1.46%, while the S&P 500 has marched up by 7.4% over the same time period. In this article, I evaluate whether if the investment thesis is still intact and if the stock still represents an attractive investment. So let’s get started.

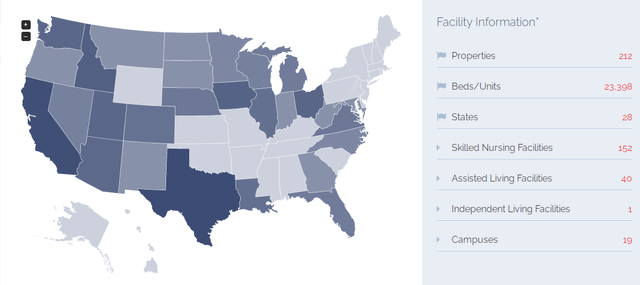

(Source: Company website)

CareTrust REIT is a healthcare REIT with a geographically diversified portfolio of 212 properties spread across 28 states and 23 operators, with triple-net leases in place. The company has over $1.7 billion in property investments in skilled nursing facilities (SNF), assisted living facilities (ALF) and independent living facilities.

Currently, skilled nursing facilities make up 72% of the overall portfolio, while Assisted/Independent Living and Campuses (SNF+ALF) make up the rest. Texas and California have the most properties with 39 and 34, respectively.

(Source: Company website)

There has been plenty of headline risk surrounding COVID-19 and nursing homes. However, it seems like the company’s operators are getting a handle of the situation, starting with enhanced rapid testing capabilities, as management noted during the latest conference call:

“We are also encouraged by the recently commenced federal rollout of point of care rapid results testing to nursing homes nationwide. The government is reportedly delivering 600 to 700 testing platforms a week with an eye to getting them into all of the nation’s 15,000 nursing facilities as quickly as possible.

Several of our facilities are near the top of the distribution list. This has been a giant missing piece in the infection control puzzle, the nation’s inpatient care facilities, short of having an effective vaccine point of care, rapid results testing the likely be the biggest advance in the ongoing war against COVID-19.