The recent market selloff – particularly in tech stocks – has presented us with some real bargains. I think most people would agree valuations in tech stocks were a bit frothy before the sharp meltdown we’ve seen in the past couple of weeks, but with the reset in share prices, I’m buying market leaders for the next phase of the rally.

One such market leader is software company Docusign (NASDAQ:DOCU), which has benefited massively from shutdowns. The company’s software has a very long runway for future growth given it allows people to securely sign agreements without having to be in the same room, and it has been bid up in recent months commensurately.

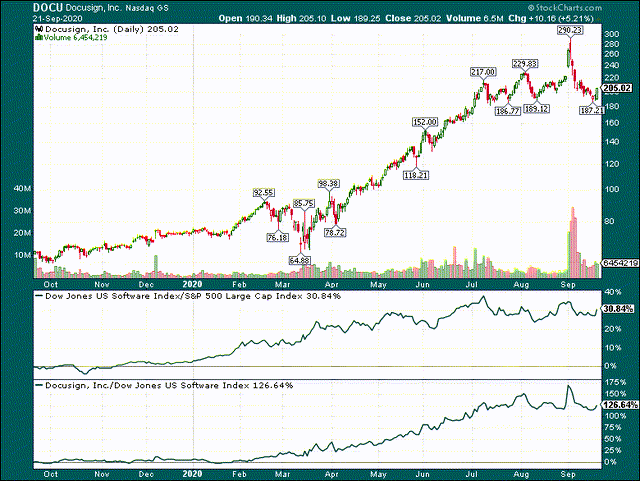

We can see that Docusign is part of the software index, which has pummeled the S&P 500 this year. That strength against the broader market has remained through the selloff, and Docusign has managed to trounce its high-performing peer group. This is exactly what I look for in a stock to buy as owning the leaders of leading groups is the best way to beat the market.

Apart from that, Docusign’s recent selloff brought shares into the $180s, where it has strong price support from its last two selloffs. The stock hit the mid-$180s a couple of trading days ago, and has bounced strongly from that level. This, combined with what I’ll show below, has me very bullish on Docusign.

The selloff generates opportunity

There are many ways to determine if a stock is at a good price to buy, but one way I like to look at price action is through rolling returns. The idea is pretty simple; pick a time frame and plot returns for that time frame over time to spot good points to buy and sell. Below, I’ve done that for two time frames and I