eXp World Holdings Inc. (NASDAQ:EXPI) is a cloud-based residential real estate company operating both a brokerage along with a technology platform for related services. The low-cost structure compared to traditional brick-and-mortar competitors has facilitated strong growth over the past decade, attracting agents and brokers with unique incentives and compelling commission draw. EXPI stock is up nearly 250% this year, with the company reporting record sales and earnings driven by strong trends in the U.S. housing market with a wave of buyers since the COVID-19 pandemic emerged. While continued uncertainty over the strength of the economic recovery warrants caution, we like EXPI with its disruptive business model and think the stock has more upside with an overall positive outlook.

(Source: Finviz)

EXPI Q2 Earnings Recap

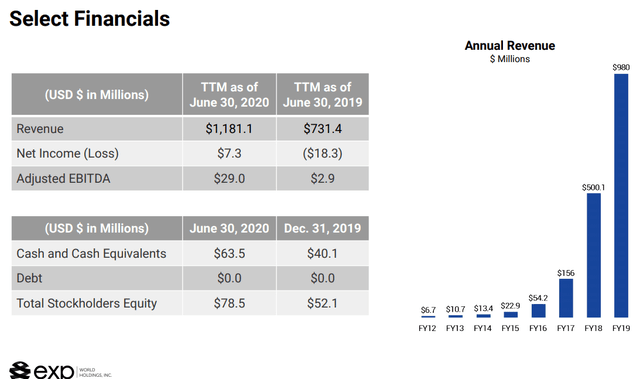

EXPI reported its Q2 earnings on August 5th with GAAP EPS of $0.11, which was $0.07 ahead of expectations. Revenue on the quarter at $354 million represented an increase of 32.6% year over year, also beating estimates. Financially, all metrics have strengthened given the top line growth. Adjusted EBITDA of $13.6 million in the quarter of 2020 was up from just $3.8 million in the period last year. Cash flow from operations similarly increased by 57% to $28.5 million, leading to a cash position of $64 million with zero long-term financial debt. Indeed, the solid balance sheet position of the company is a strength with overall solid fundamentals.

(Source: Company IR)

This was a record quarter for the company that benefited from the unique circumstances surrounding the COVID-19 pandemic and its impact on the housing market. The combination of record-low interest rates and a trend of homebuyers looking to move out of big cities or into bigger homes fueled one of the strongest periods ever for residential real estate. To get a sense of the strength of these

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.