Currently, healthcare REITs are experiencing near-term headwinds, as nursing homes have been on high-alert in containing and preventing COVID outbreaks in their facilities. In this article, I’m focused Alexandria Real Estate Equities (NYSE:ARE), which is also in the healthcare space, but doesn’t come with the risks of the overall sector. I explore what makes ARE worth owning at the current price; so let’s get started.

(Source: Company website)

A Look Into Alexandria Real Estate

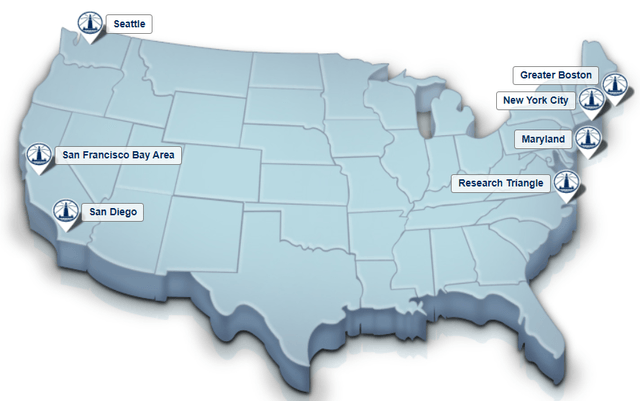

Alexandria Real Estate Equities is a leading REIT with a focus on Life Sciences, Technology, and Agricultural Technology. Its business model is focused around developing urban innovation clusters that are adjacent to the nation’s top academic institutions. As seen below, its properties are generally located near leading research institutions in the Northeast and the West coast. Last year, the company generated over $1.5B in total revenue.

(Source: Company website)

What I like about Alexandria is that while many of its healthcare REIT peers are working to contain COVID outbreaks in their facilities, Alexandria’s tenants are working to enhance testing, and are developing therapies and vaccines. This is supported by Alexandria’s leading tenants, which includes Abbot Laboratories (ABT), Johnson & Johnson (JNJ), Amgen (AMGN), Pfizer (PFE), and Moderna (MRNA), to name a few. This helps to put Alexandria’s properties at the cutting edge of scientific innovations.

In addition, the company is currently developing its OneFifteen project, which is a sprawling campus in Dayton, Ohio. This is an outpatient campus that is meant to help tackle the opioid crisis, and includes a residential and rehabilitation facility for patients suffering from opioid addiction. I see this as being a good example of the innovative and forward thinking ways that Alexandria approaches development projects.

Alexandria’s rent collection rate is currently very healthy, with a 99.5% collection rate during the latest quarter. What’s more