Introduction

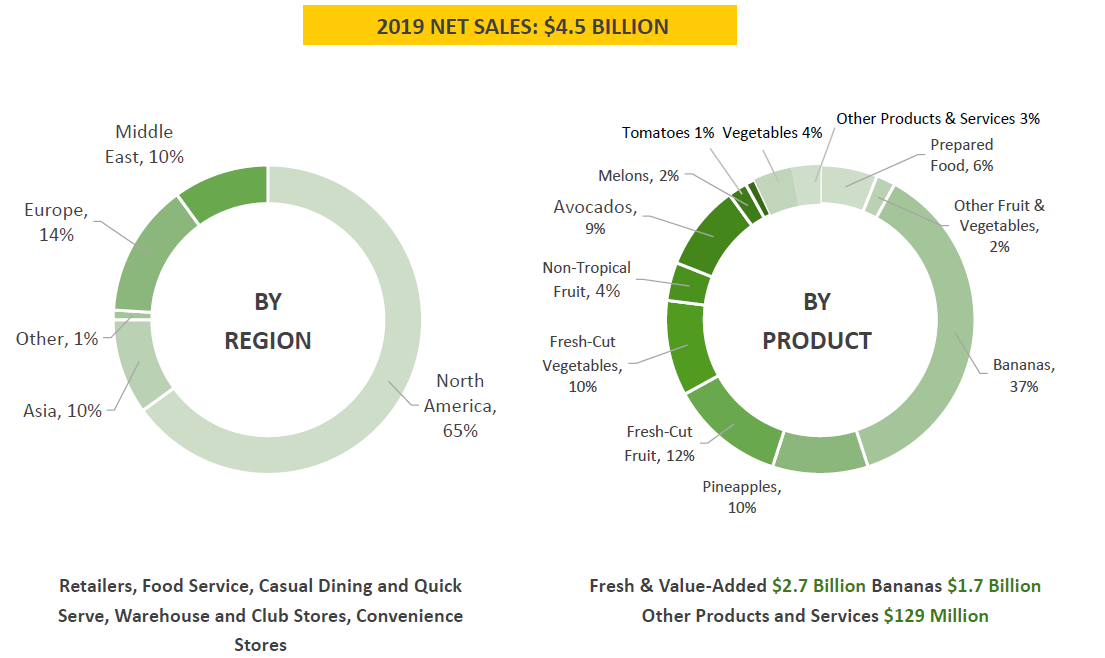

Fresh Del Monte (NYSE:FDP) is one of the world’s largest producer, marketer and distributor of fruit products and although about two-third of its sales are generated in North America, the company is active all over the world, resulting in the company offering interesting exposure to several continents.

Source: annual report 2019

The first semester was very decent

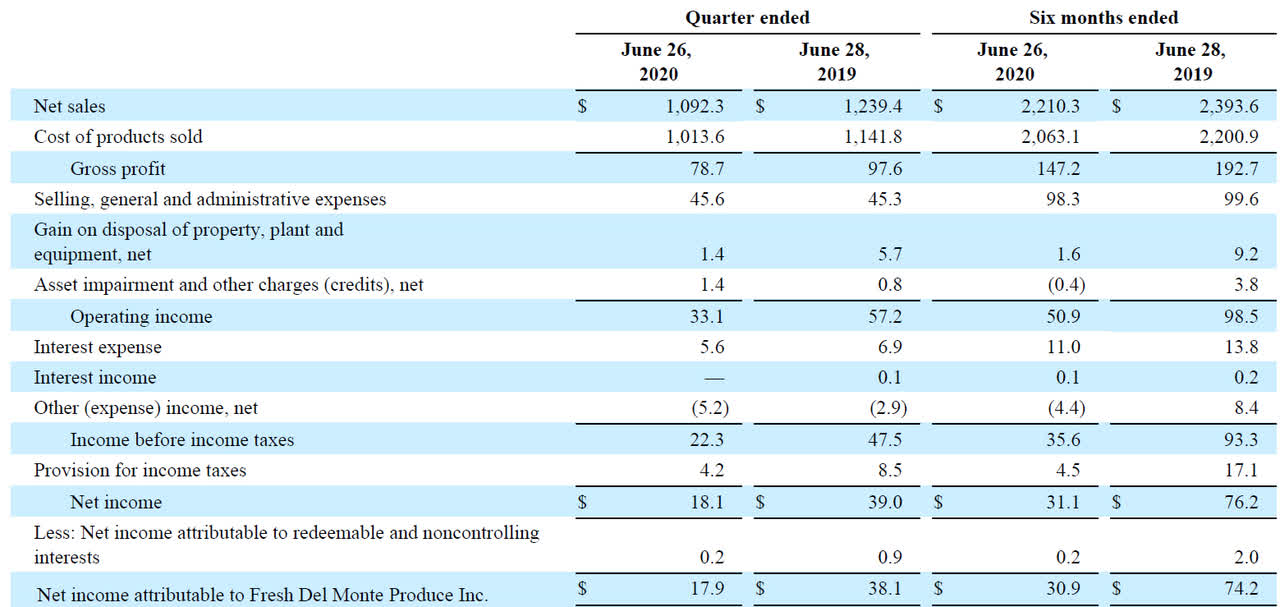

In the first six months of the current financial year, Fresh Del Monte reported a total revenue of $2.2B, which is a 6% decrease compared to H1 2019. Fortunately, FDP was able to reduce its operating expenses by 9% as well which helped to keep the damage limited. Yes, the gross profit decreased sharply, but the result clearly wasn’t as bad as it could have been. The net income of $31.1M, of which $30.9M is attributable to the company’s shareholders, is relatively weak as well, but this is a direct result of the lower gross profit in H1 2020 whereas the company also booked an exceptional gain on a disposal in H1 2019 which boosted the results in the first semester of last year.

Source: SEC filings

Additionally, COVID-19 made things more difficult for Fresh Del Monte as it had to write off about $11M of goods, which couldn’t get sold in time. As some of the produce has a relatively long lead time (think about bananas being shipped from South America on a boat), it takes a little bit of time to rethink the logistical chain to make sure the supply side meets the demand side; so we should cut FDP some slack here.

FDP successfully protected its cash flows. It reported an operating cash flow (adjusted for working capital changes and the dividend paid to non-controlling interests) of almost $79M and after deducting the $36M in capex, the free cash flow result was $43M. Definitely not as good

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!