This research report was produced by The REIT Forum with assistance from Big Dog Investments.

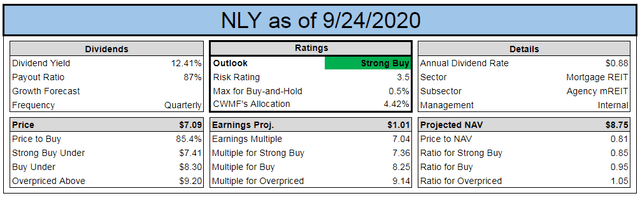

Annaly Capital Management (NYSE:NLY) trades at a substantial discount to book value. We find the current valuation quite attractive. Compared to most of the other mortgage REITs, NLY has a lower risk rating at only 3.5. That's still a significant amount of risk, but it is lower than most peers. Further, NLY recently internalized management and thus should expect to have a higher price-to-book ratio compared to their peers. Our outlook is shown below:

Source: The REIT Forum

Portfolio

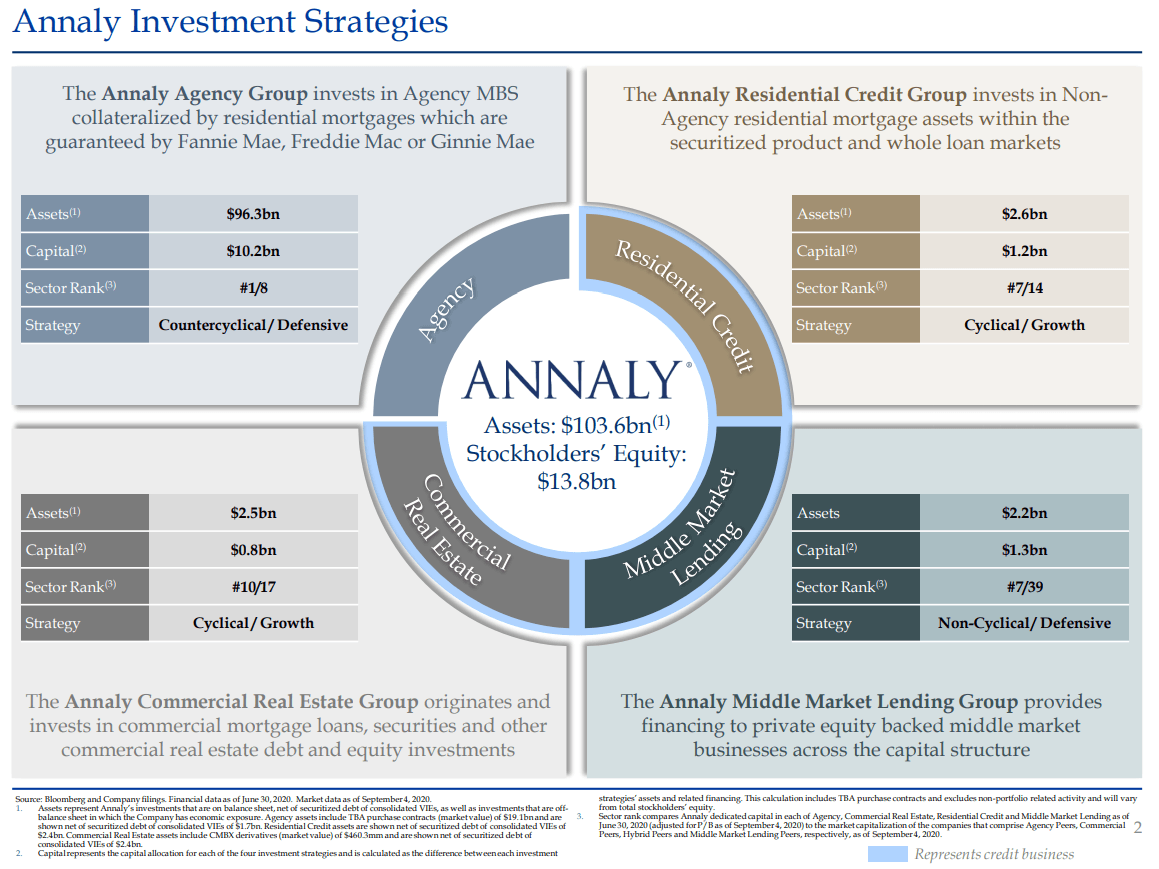

The portfolio for Annaly Capital Management is split into four main groups, but one of those groups represents more than 90% of the assets:

Source: NLY

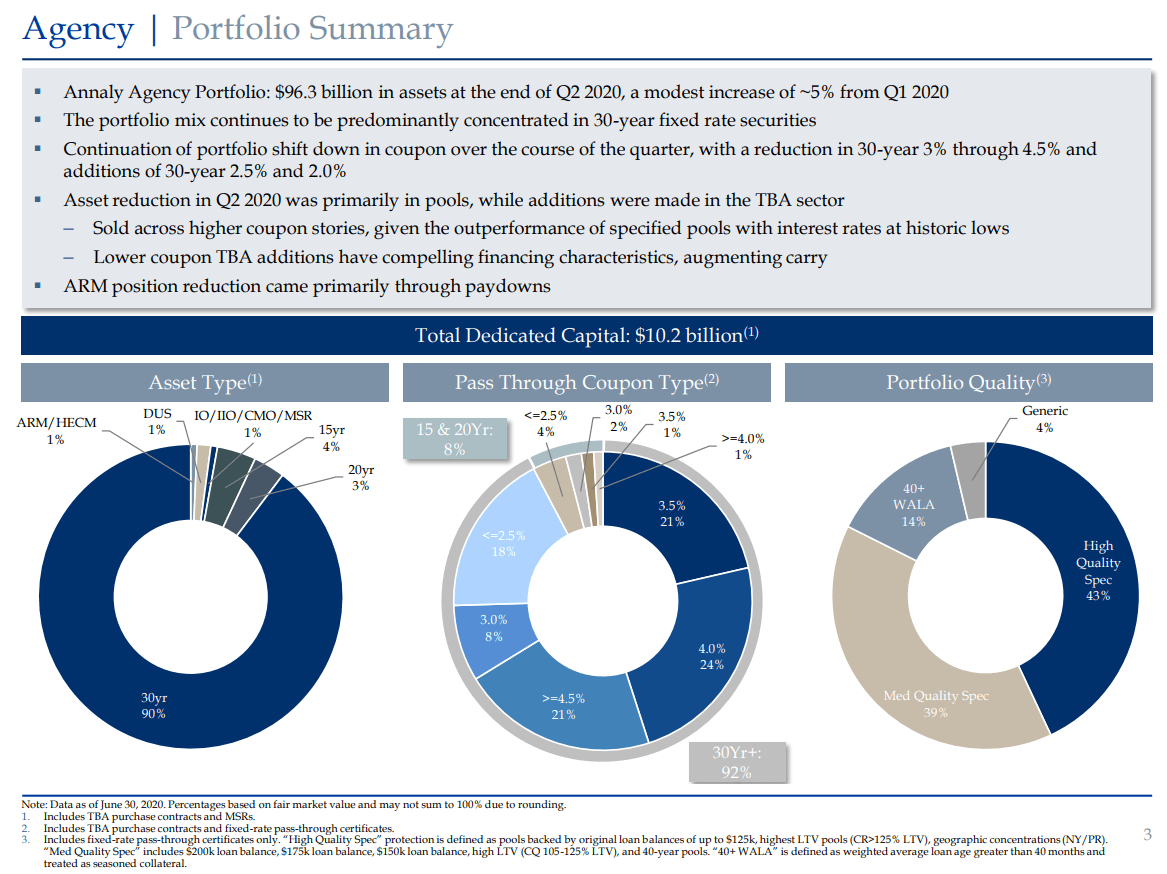

Within that "Agency" part of the portfolio, the vast majority of the securities are 30-year fixed-rate MBS. See the chart in the bottom left corner:

Source: NLY

Notice that "30yr" represents 90% of the "Agency" category. These are very common mortgages for a residential mortgage REIT to own.

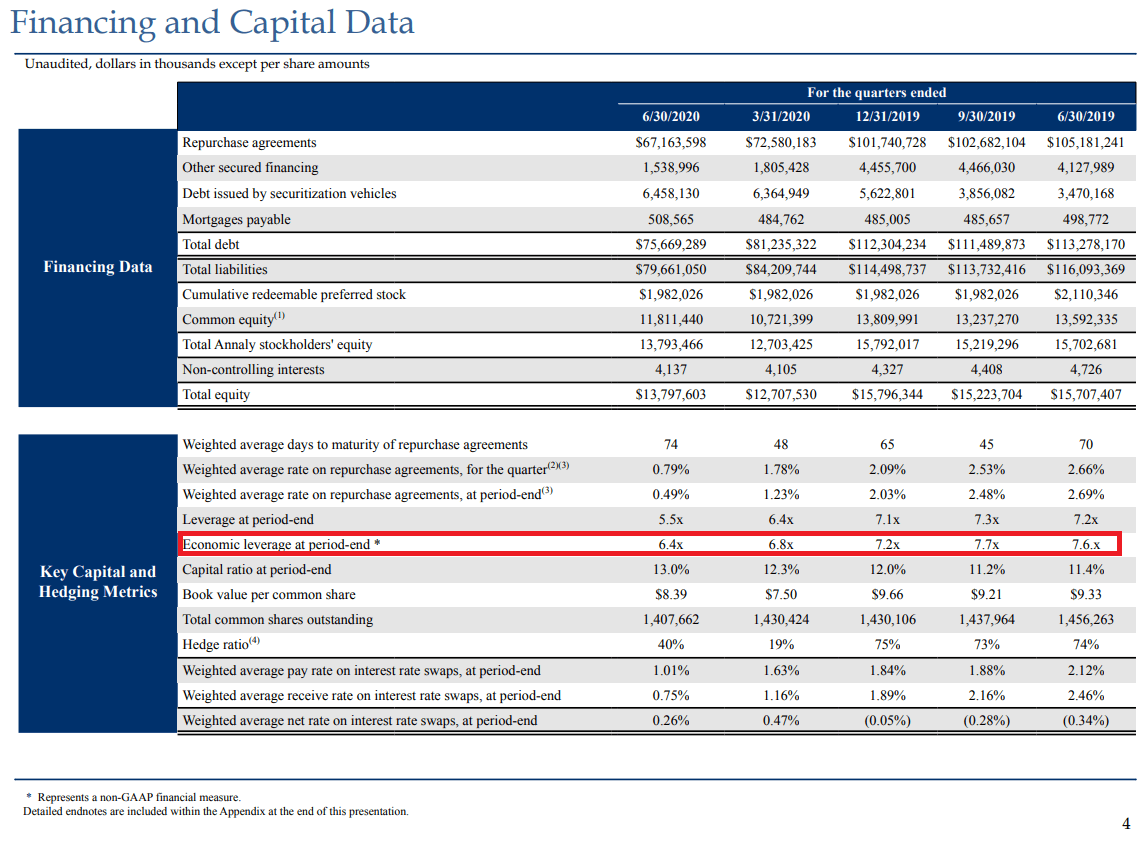

Annaly's overall economic leverage at the end of Q2 2020 was at the lowest level seen in many quarters:

Source: NLY, red box added by author

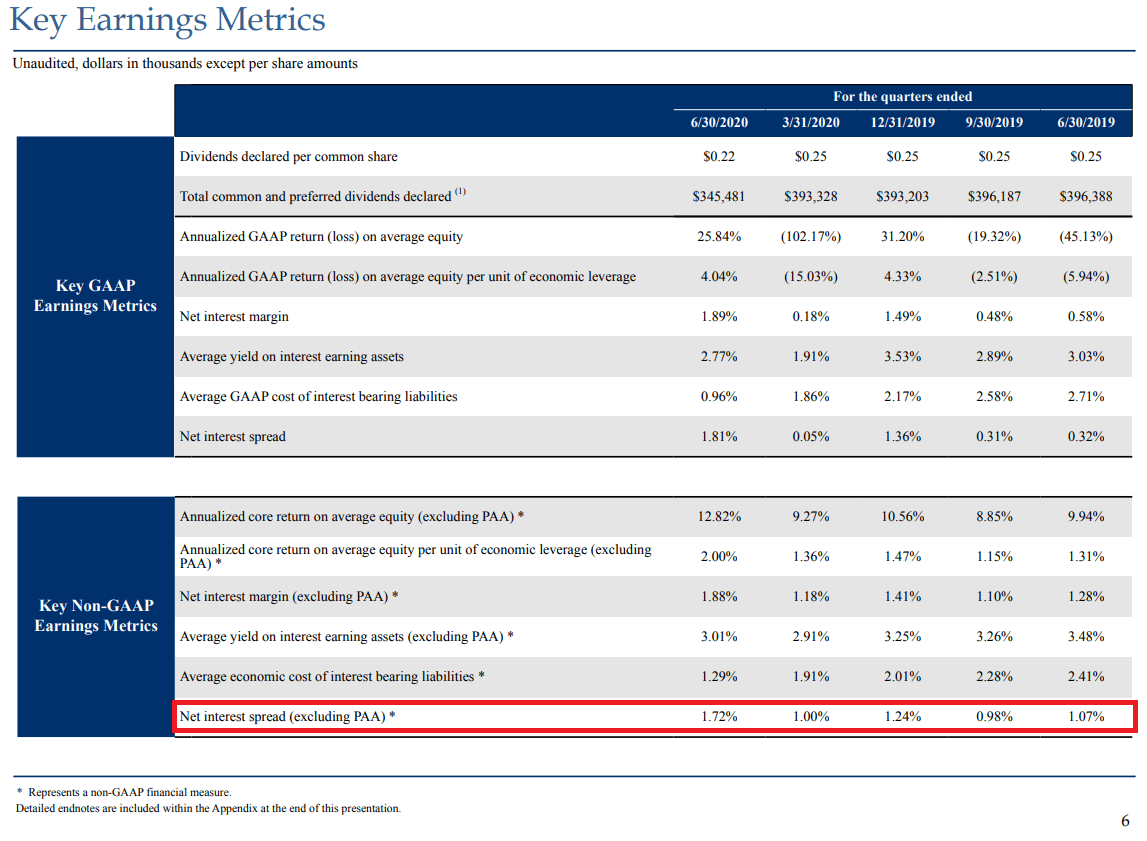

The mortgage REIT sector could gain more favor with investors over the next several quarters as they highlight the substantial increase in the metric called "Net Interest Spread (excluding PAA)":

Source: NLY, red box added by author

The stronger net interest spread, enabled by adjusting the hedge portfolio, is a benefit to Core EPS (excluding PAA). We've discussed PAA several times before and may need some entire articles dedicated to the topic. The simple version is that it represents an adjustment to interest income. Each quarter the mortgage REIT is estimating the level of prepayments. When they change their estimate, they need to adjust for the prior periods if they were estimated higher or lower. The result is a big swing flowing through the income statement. Demonstrating exactly how this works is beyond the scope of the article, but we want to highlight that the net interest spread improved substantially.

We're bullish on the common shares from NLY.

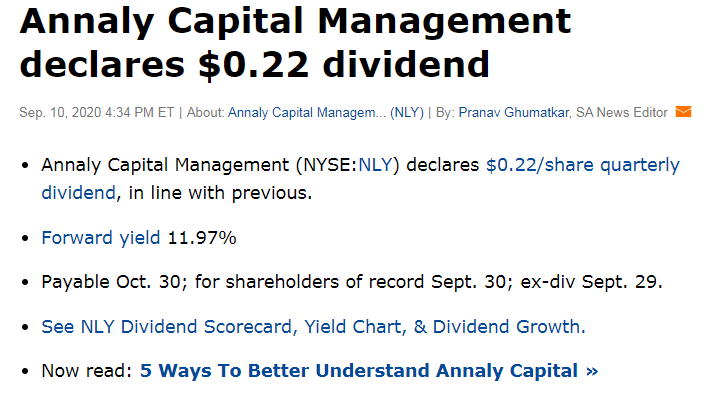

Ex-Dividend Date

As a reminder, shares of NLY go ex-dividend on 9/29/2020:

Source: Seeking Alpha

Let's move on to the preferred shares.

Preferred Shares

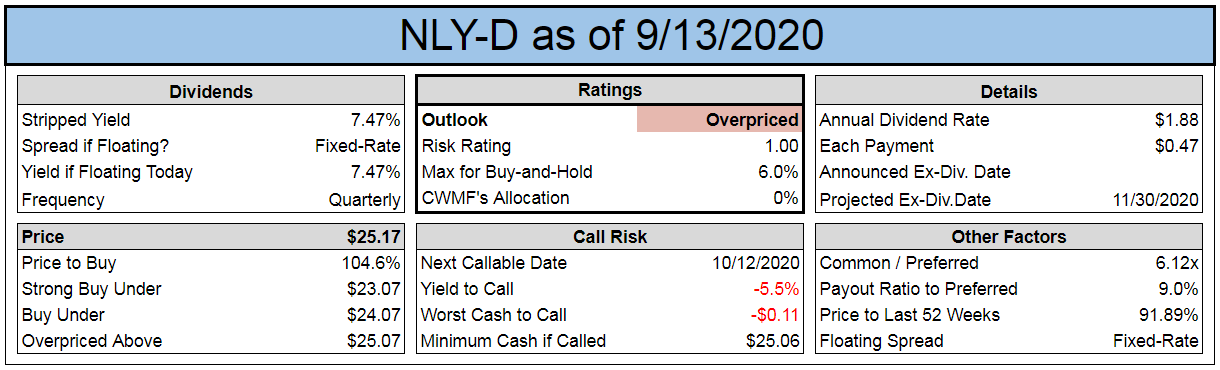

Annaly Capital Management's preferred shares are trading at substantially different prices. The market has a clear preference for NLY-D (NLY.PD). NLY-D still trades over $25.00 and is callable at any point on 30-days notice. If the economy recovers in full and credit spreads thin, NLY would want to call and issue lower-rate shares.

Consider the yield to call and "worst cash to call", both in the bottom middle box:

Source: The REIT Forum

Those values are negative because of the adjustment for dividend accrual. Shares trade at $25.17. They have a small amount of dividend accrual and would require 30-days notice on a call, but the shares regularly pay their dividend 30 days after the ex-dividend date. That means that effectively the "Accrual" for the final 30 days is essentially wiped out if a call occurs. These were often great shares, but the risk/reward is less attractive here. Buy-and-hold investors can still keep right on holding. The income is fine. It's just the risk of a call within the next two years making shares unattractive for new investments.

The Call Risk Scenario

The interesting dynamic for investors in NLY-D is the call risk. Returns are unlikely to significantly exceed the dividend yield. For an investor to buy above $25 and earn a return above the dividend yield, they would need to have significant dividend accrual. That means they would need the shares to have nearly a full dividend already earned. That isn't the case. For investors who are seeking a long-term investment, call risk is a significant concern.

If the market continues to recover and credit spreads thin, NLY may be able to issue a new share at a lower coupon rate. That would enable them to call NLY-D. Consequently, if the economy performs well over the next 2 years, it is quite possible that the investor's shares of NLY-D would disappear. They would be compensated by the call value, but their opportunities to reinvest would be limited. If credit spreads widen, NLY would not call NLY-D. The only call scenario is one where the investor is left with less attractive options. This is an area where the other preferred shares from NLY are more appealing.

The Fixed-to-Floating Shares

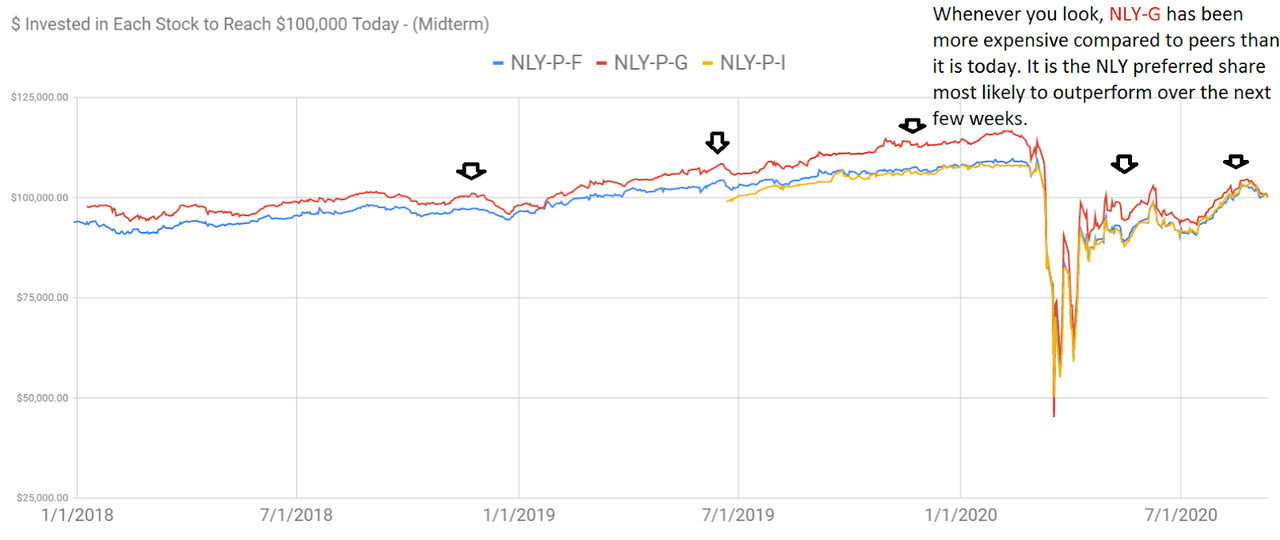

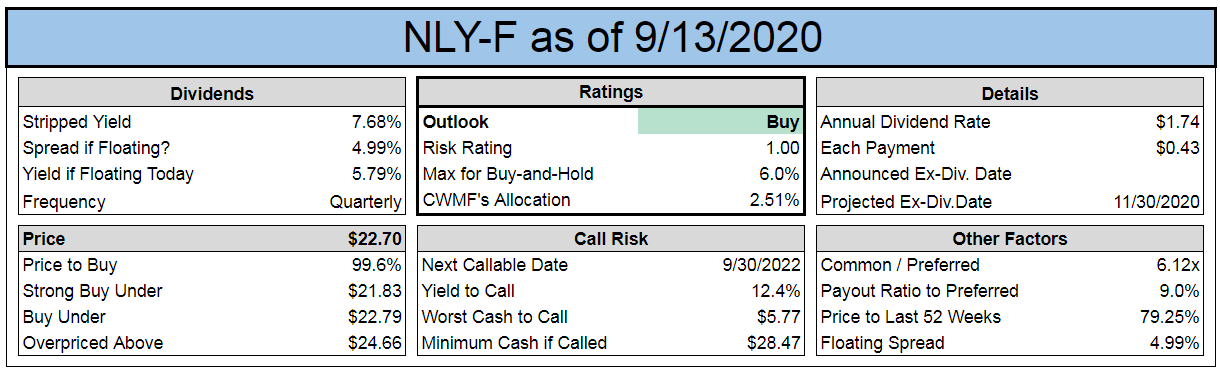

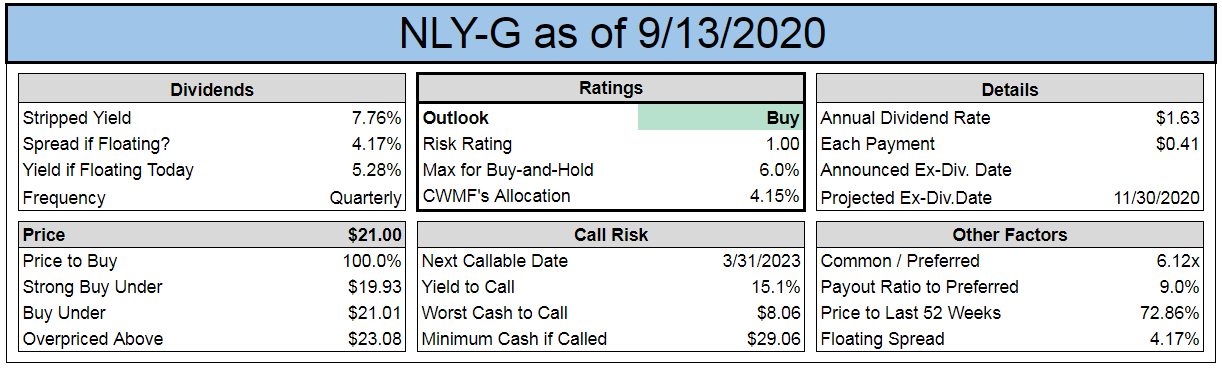

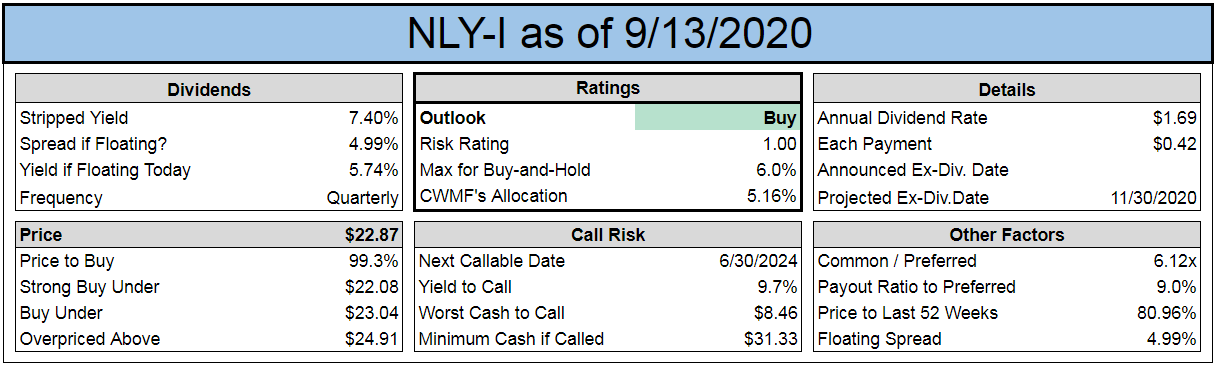

The other NLY preferred shares still have a respectable amount of upside. NLY-F (NLY.PF), NLY-G (NLY.PG), and NLY-I (NLY.PI) offer similar values to each other at current prices:

Source: The REIT Forum

Each lands just within the target "buy under" range. For NLY-G, it only lands inside by $.01, so the "price-to-buy" comes in with a rounding error at 100.0%. However, NLY-F and NLY-I are only slightly further inside. These options are all pretty comparable and it depends on what investors want.

Historically, we often said NLY-G was too expensive relative to the others. While it is technically closest to our target "buy under" value, it is also the share most likely to jump in the near-term. We can demonstrate that with the $100k chart:

Source: The REIT Forum

No matter when investors bought in, NLY-G has been a slight underperformer vs. the other NLY preferred shares. This only applies to buy-and-hold strategies though. There have been plenty of opportunities for investors to jump back and forth between the fixed-to-floating preferred shares if they desired. Each trade often accelerated the total return for shareholders, since a round trip (for example selling NLY-F, buying NLY-G, then selling NLY-G to buy NLY-F) would leave them with more shares than they had initially. We can all agree that 1,010 shares of NLY-F would be more valuable than 1,000 shares. That is the primary advantage of occasionally taking those round trips through the different series of preferred shares.

A large part of NLY-G's weaker performance for the last few years is just coming from the last several months. There's a good chance some of that reverts, so NLY-G will probably outperform slightly using the starting prices shown in the index cards.

Comparing NLY's Fixed-to-Floating Preferred Shares

They carry a substantial discount to call value. If NLY were to call these shares in the future, the investor would get a significant capital gain. The main downside to these preferred shares is the floating rate in the future. NLY-F and NLY-I carry significantly better spreads over short-term rates when compared to NLY-G. However, NLY-G has a lower share price and carries a solid dividend until then. At recent prices, these 3 shares have been quite competitive.

Let's talk about the scenario where the dividend rate is a little over 5%. In this scenario, the short-term rates must be near 0%. We might continue to have 0% interest rates for several years or we might see the dynamic change. Neither I nor you will know the future. If you think you know the future, please begin trading options on long-term Treasury ETFs. You will either become incredibly wealthy or discover that you were simply arrogant to believe you knew the future of interest rates. It is okay to have an opinion, but don't confuse opinion with certainty. Many fools have lost their portfolios because they couldn't separate the two. Investors can hedge by owning some shares which are fixed-rate and others which are floating-rate. If the short-term rates stay near 0% for several years, you are unlikely to find other great low-risk positions with a high yield.

If a savings account is only paying 0.1%, then investors in these preferred shares are still earning a reasonable risk premium. Consequently, the upside to call value is providing enough protection for shareholders that the floating rate shares look better than the fixed-rate share today.

Conclusion

The common shares remain at a substantial discount to book value. That discount could easily shrink over the coming quarters and result in prices rising. The risk level on the common shares is lower for NLY than for several of their peers, but they are still far from low risk. For the buy-and-hold investor, it often makes sense to look at the preferred shares instead.

Investors can find some value in the NLY preferred shares. The fixed-to-floating shares can be a great match for buy-and-hold investors, but investors should always check the latest prices before entering orders.

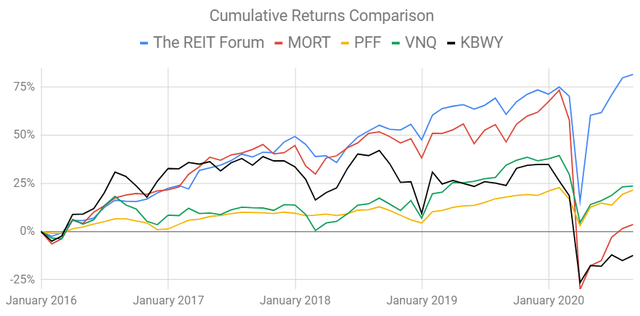

Our method works. We know because we buy the same shares we recommend. We track our results on a real portfolio and we compare our returns with the major ETFs for our sector:

Those four ETFs are:

- MORT - Major mortgage REIT ETF

- PFF - The largest preferred share ETF

- VNQ - The largest equity REIT ETF

- KBWY - The high-yield equity REIT ETF

Sign up now. Take advantage of our September sale!