Flash PMIs for September 2020 around the world add more evidence to the possibility of a global slowdown during the economy's all-important rebound quarter. Q2 was the big downturn, and so it is always going to be Q3 where the bounce-back would be sharpest. While that has definitely been the case, concerns are mounting for what might follow in Q4.

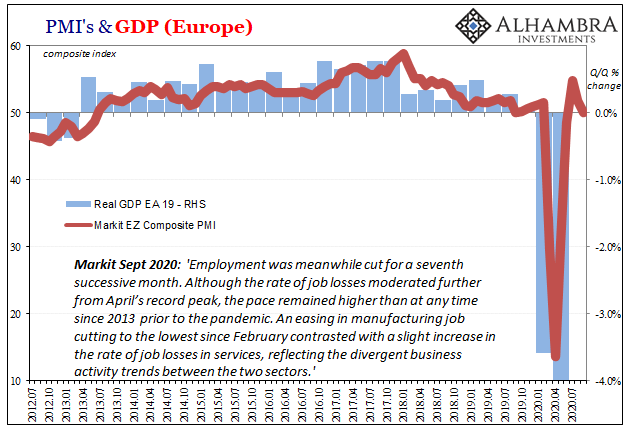

As we've seen elsewhere, in too many places, in July. It showed up in Europe again; yesterday IHS Markit reporting a sharply lower composite PMI for its flash September estimate. While manufacturing continues to only modestly accelerate, the service sector index has fallen back to just 47.6, below 50 again therefore renewing/adding to uncertainty over the upward trajectory.

The peak in Europe according to Markit's estimates? July.

The US seems to have fared comparatively better, nothing new, but after accelerating in August, the flash estimate (composite) for September slipped. Again, the service index is to blame. Still near last month's multi-year high, as with all these PMIs we can't help but wonder why it isn't so much higher? That's really the concern about Q4.

The third quarter, again, rebound and reopening momentum. That has to carry over into Q4 but even the highest of these sentiment surveys keep coming up way short. Add to that the possibility of this late summer setback, a growing one, and it's no wonder markets seem to have become a little more angst-ridden of late.

As my colleague Joe Calhoun noted yesterday, that begins with how the US$ seems to have caught a bid after being declared dead and buried all summer. It had been falling against most currencies, notably the euro (and pound). However, despite crash hysterics, the exchange rate had remained substantially above its pre-GFC2 levels. Suspicion already that things may not have been as flood-like as had been reported.