Ian's Million Fund, "IMF," is a real-money portfolio that I've written about monthly since January 2016 here at Seeking Alpha. The portfolio is a largely buy-and-hold group of ~130 stocks. Each month, I buy 10-30 of the most compelling stocks available at then-current prices, deploying $1,000 of my capital plus accumulated dividends. If things go according to plan, this portfolio, which began when I was 27, will hit one million dollars in equity in 2041 at age 52. I intend it to serve as a model for other younger investors.

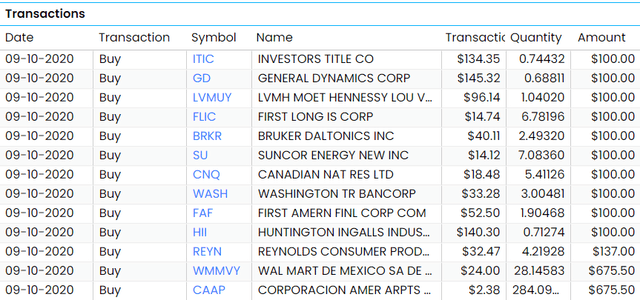

With the market on a bit of a decline, I decided to put the September IMF funds to work earlier two weeks ago. I was particularly eager as I had suitable replacements for the recently sold position, and wanted to get that moving. As it turns out, the market kept dropping, and some of these stocks are now a few percent cheaper; happy bargain hunting, In any case, here are my buys for the month:

To be clear from the top, I invested the usual $1,000 a month equally: $100 across 10 stocks. The Reynolds (REYN) purchase was funded with the portfolio's dividends from August. Expect Reynolds to be the recipient of dividend funds for the foreseeable future. This is my new Hormel Foods (HRL), at least under $35, and I intend to size this position up. Reynolds just guided up on earnings for the year and the stock still didn't move. Analysts are missing an obvious and pretty wide mis-pricing within consumer staples here.

And then you've got the last two. I sold the portfolio's long-running JD (JD) position earlier this month. JD stock had nearly tripled from the portfolio's cost basis, and its valuation has gotten way ahead of its fundamentals. As JD was a top 10 portfolio holding, that

This is an Ian's Insider Corner report published Sept. 10 for our service's subscribers. If you enjoyed this, consider our service to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.