Annaly Capital Management (NYSE:NLY) is the most widely researched mortgage REIT on Seeking Alpha. The sheer recognition draws in more analysts hoping to find a wider audience for their work. Today, it also happens to be one of the bargains in the sector. Because so many investors begin learning about mortgage REITs by researching Annaly, we aim to make our articles on NLY a little bit easier for new investors.

That means we're going to hammer in one some key points. Rather than giving you data and telling you the conclusion you should reach, we're showing you how to reach the conclusion.

Price-to-Book Matters More Than Your Metric

Many analysts come into mortgage REITs putting WAY too much faith in the wrong metrics. That sets them up for failure. Analysis of the mortgage REIT starts with analyzing book value. Everything else comes later. Book value is the foundation of good analysis for mortgage REITs.

Note: Book value is not the foundation of analysis for Amazon (AMZN), Microsoft (MSFT), or Tesla (TSLA). Occasionally we get a reader who cannot comprehend the possibility that different investments might be analyzed in different ways. This article isn't for that investor. If an investor can't accept those basic truths, they are already doomed and should stick to dollar-cost averaging into a low-fee diversified index fund. By the way, that's a fine strategy for most 401(k) accounts as well. Nothing wrong with making that part of your overall strategy.

So why does price-to-book matter so much? Because we need to evaluate the most likely future path for the share price. That's not the same as saying that we know which direction it will go. We don't KNOW that information. However, we can figure out what is most likely.

This Isn't Market Timing

The concept of "Market Timing" starts with the word "Market". We aren't trying to forecast the entire stock market. Further, we aren't focused on the "Timing" either.

Source: Dilbert

It isn't about timing. It is about valuation. I don't care if NLY is $7.28 on Friday afternoon, Monday morning, or Wednesday night. We are focused on valuation. That means knowing the stock price (pretty easy!) and the book value (harder than you think).

Comparing Price and Book Value

Ideally, you want estimates for current book value. You want the book value as of the moment you are making your choice. We have regular updates from Scott Kennedy on estimated book value for the mortgage REITs and BDCs. These are frequent updates coming to us between the earnings releases, so we almost always have a more recent estimate than "the market". The only difference is when management chooses to state the book value as of the present day while they are talking to analysts. For that day, the entire market has the current value.

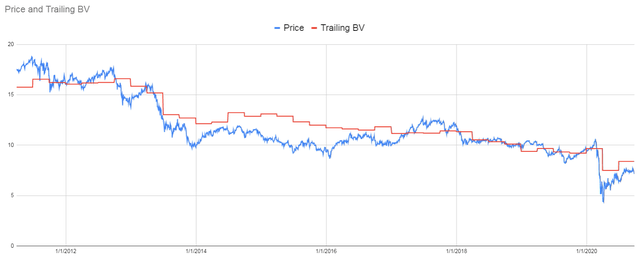

When earnings are announced in August and a quarter ended in June, the book value from June 30th is more than a month out of date by the time it is printed. Nonetheless, we can demonstrate our point using a chart showing price to trailing book value:

Source: The REIT Forum

Would you say those lines are strongly correlated? Of course!

Now someone is going to be a downer and point out that the book value and price trend towards the bottom right side. That's true. The chart is IGNORING THE DIVIDEND.

During that time, NLY paid out $12.89 in dividends per share. That's where the money went. If NLY didn't have the REIT requirement of paying out a dividend and simply conserved all of its cash, the value would be going up and to the right.

Simple Price-to-Book Guidelines

If the price-to-book is going above about 1.07 to 1.10, you probably should've taken gains already. If the price-to-book is under .85, you should probably be buying shares.

That's the simple version. Pretty clear?

Annualized Core Return on Average Equity Excluding Premium Amortization Adjustment

Okay, that's an absurdly long name. We get it. However, this is a metric NLY began reporting and it makes my job easier. Why? Because it means I can show you a chart and tell you what I see on the page. That's about the easiest form of analysis.

Note: Saying whatever you feel like isn't analysis, contrary to what some people might think.

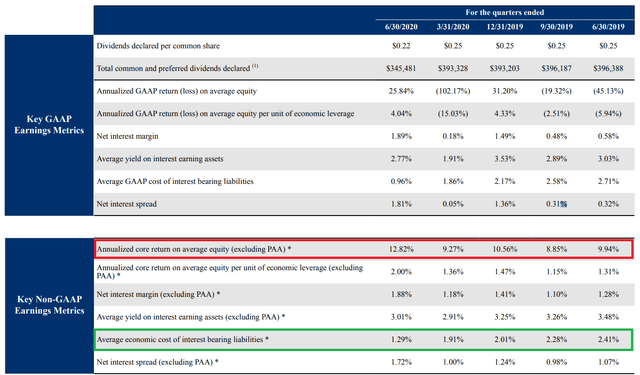

Here's the table:

Source: NLY

We added a red box to draw your attention to the metric. This is exceptionally useful because it helps us to hammer home one of the key points. Notice that the value is reasonably steady? Aside from Q2 2020, the value ranged from 8.85% to 10.56%. That's within a reasonable range. This is allowing you to evaluate Core EPS (Core Earnings Per Share, its primary earnings metric) relative to the average book value for the period.

The value spiked up in Q2 2020 because the REIT had the opportunity to adjust its hedging portfolio. We demonstrated the impact of modifying its hedges by adding the green box. You can see that the average economic cost of funds plunged. Consequently, the company has a lower interest expense, which is driving the higher annualized core return on average equity (excluding premium amortization adjustments).

Dividend

The current dividend rate is $.22 per share. If we compare that to a recent estimated book value of $8.75, it would be about a 10.05% yield on book value (and 12.1% yield on the stock price).

Would an annualized core return on average equity of 10.05% would be difficult to achieve? Not particularly. Given the change in the hedging profile, it looks easier than before.

Index Card

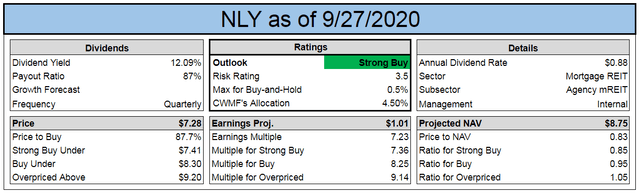

Below we have the latest index card for NLY (as of mid-day on Sunday 9/27/2020):

Source: The REIT Forum

Note: Scott will be updating estimates on book value again soon, so slight changes are expected. The estimated NAV of $8.75 comes from 9/18/2020. The terms NAV (Net Asset Value) and BV (Book Value) are generally interchangeable for mortgage REITs. They are not interchangeable for other types of REITs, only mortgage REITs.

Shares go ex-dividend on 9/29/2020 for $.22 per share, so investors reading this on 9/29/2020 or later should understand that prices may have dipped due to the shares going ex-dividend.

Shares currently offer a 12% dividend yield and 17% discount to book value.

Conclusion

Annaly Capital Management still remains attractively priced. A price-to-book ratio (same as Price to NAV for mortgage REITs) of 0.83 is pretty low for NLY. While larger discounts do occur occasionally, it is pretty rare. As the charts demonstrate, the price is substantially below the trailing book value. As our estimates indicate, the price is also substantially below current estimated book values.

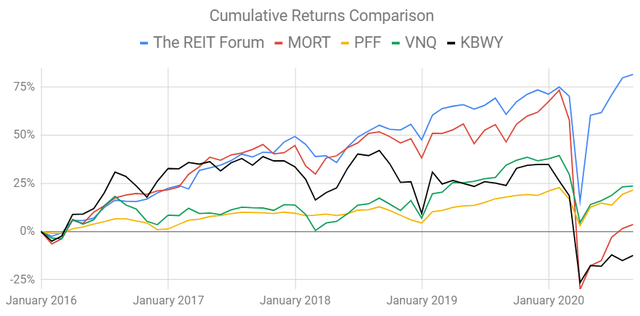

Our method works. We know because we buy the same shares we recommend. We track our results on a real portfolio and we compare our returns with the major ETFs for our sector:

Those four ETFs are:

- MORT - Major mortgage REIT ETF

- PFF - The largest preferred share ETF

- VNQ - The largest equity REIT ETF

- KBWY - The high-yield equity REIT ETF

Sign up now. Take advantage of our September sale!