AerCap Holdings (NYSE:AER) and Air Lease Corporation (AL) are two of the largest publicly traded aircraft leasing companies (~$3B market capitalization, respectively). Both have been significantly impacted by COVID in the past six months, with shares of each business diving up to 80% in the first days of the panic. Since then, each has focused on liquidity and taking a long view of the return of air travel.

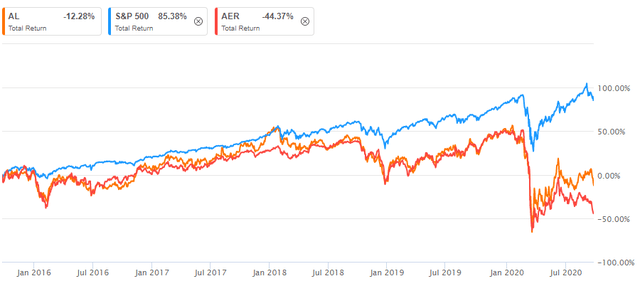

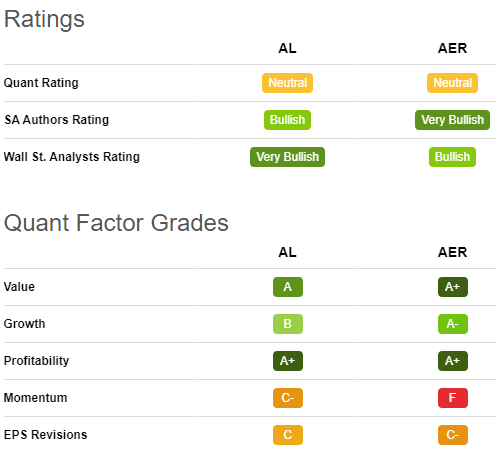

As you can see below, they rate very similarly on Seeking Alpha's ratings system and quantitative factors, and both have significantly underperformed the S&P over the last five years, even prior to COVID:

(Source: Seeking Alpha)

(Source: Seeking Alpha)

Business Model Overview

The marketplace role of aircraft lessors is ordering large numbers of aircraft from manufacturers (Boeings (BA) and Airbuses (OTCPK:EADSF) (OTCPK:EADSY) - "OEMs") many years in advance. Because of their purchasing scale, lessors can often negotiate significant discounts compared to airlines that might order the planes directly in smaller quantities. They can then in advance negotiate leases with various airlines, often for 10 years or more, to provide the aircraft for operation by the airlines. This benefits the OEMs by concentrating their sales and making their orders more predictable, while also making it easier for airlines to secure planes on shorter notice via leases instead of ordering from the OEMs years in advance. It also removes the responsibility to retire the aircraft from the airlines.

For these two lessors, a high-level overview of their aircraft is as follows:

- AER: As of June 30, 2020, they owned 931 aircraft (all but 41 were leased) with an average age of 6.4 years. They managed an additional 104 aircraft, and had outstanding orders for 322 more (over 50% leased). 20 of the off-lease aircraft are designated for sale. Some find AER's