Investment Thesis:

ICICI Bank (NYSE:IBN) has historically been regarded as a "mediocre" bank compared to its peer HDFC Bank (HDB). Since its founding in 1994, the bank has struggled with poor underwriting, a boom and bust growth strategy, and poorly timed equity raises tied to execution issues. All in all, this has led ICICI to trade at a significant discount to HDFC on a P/BV basis as seen below:

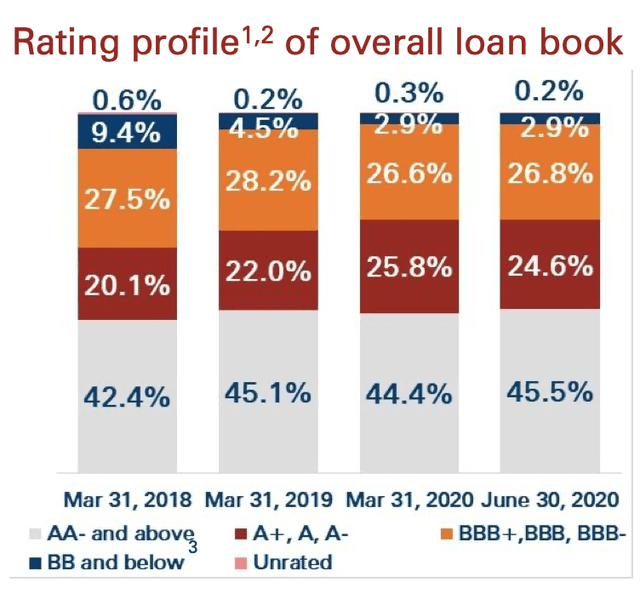

Historically, much of this discount was warranted, but several recent developments have made me bullish on the stock. Ever since ICICI installed its new CEO in late 2018, the company has made several key improvements. For one, ICICI has now driven strong CASA deposit growth which has several benefits, namely a lower cost of funds. This will help drive a superior NIM profile moving forward. Furthermore, there is a drive towards credit quality and sustainable growth that should reduce volatility in this name. As seen in the chart below from a recent company presentation, the company is slowly growing the overall mix of lower risk rated loans while decreasing the higher risk rated loans.

Much of this is due to a shift toward retail loan vs domestic corporate loan that have lower default rates. Additionally, the company is reducing overall borrower concentration with the top 10 borrowers now making up 12% of the book in 2020 vs 14% back in 2018. This diversification will help reduce single name risk within the company's portfolio.

On the liquidity front, even in the midst of the crisis and due to the recent capital raise, the company is well capitalized with the liquidity coverage ratio hitting close to 150% in June. The company also has strong profit margins as illustrated below. This helps illustrate the strong operating leverage that should allow the company to endure through this crisis.