The political economy of South Africa is a mess. The South African government often fails to even provide basic services. For example, earlier this year, there was a wave of power outages euphemistically called “load shedding.” Inconsistent power devastated productivity. According to Transparency International, 18% of public service users paid a bribe in the past 12 months, and 64% of people believe corruption has become worse in the past year. A large portion of funds set aside for Covid relief were lost due to corruption.

South Africa’s Covid lockdown was among the strictest in the world, and consequently, the economic downturn has also been among the worst. The most recent unemployment rate is over 30% according to Trading Economics. GDP contracted at an annualized rate of 17.1% during 200Q2. For the decade, government debt has increased relative to GDP every year, and is currently over 62% of GDP. This year, the government deficit is expected to exceed 15% of GDP, the largest one-year increase since the end of apartheid. The weak economy and fiscally-unsound government have continued to undermine foreign capital inflows.

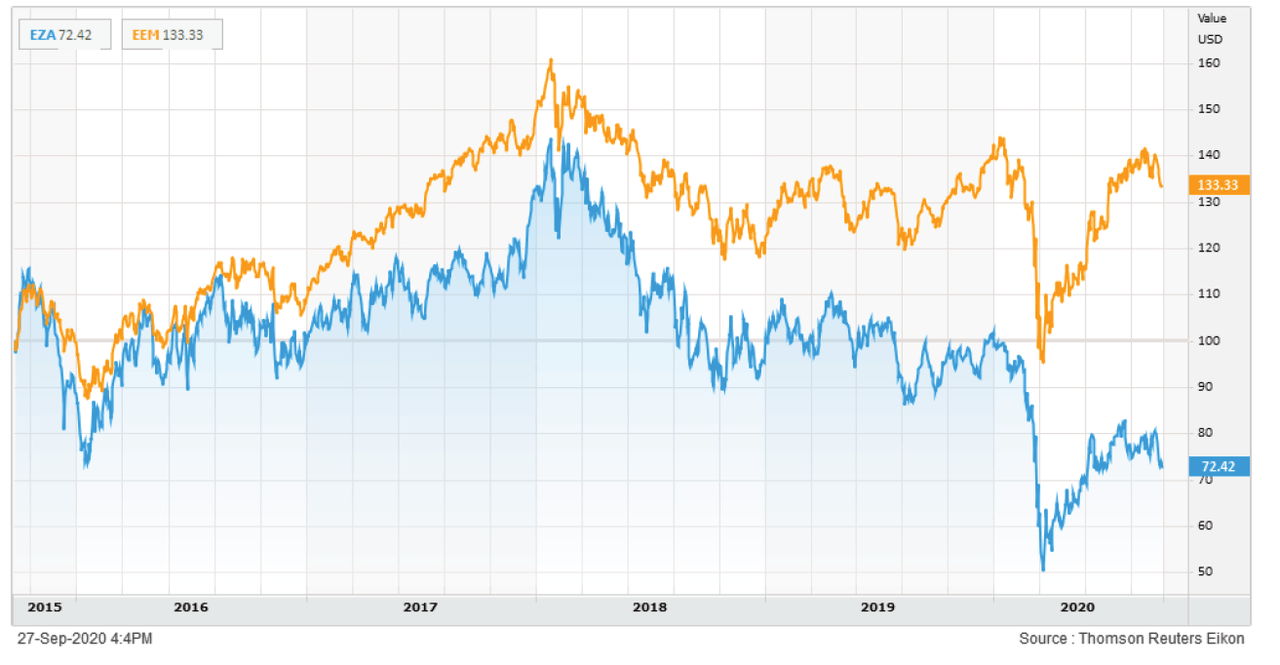

South Africa has performed far worse than the broader emerging markets universe in recent years. This chart compares the iShares MSCI South Africa ETF (NYSEARCA:EZA) to the iShares Emerging Markets ETF (EEM):

Source: Thomson Reuters EIKON

Unsurprising, South Africa is also cheaper than the broader EM universe, which is itself cheap by historical standards. The average P/E ratio for EZA is 14.62, compared to 15.49 for EEM.

Yet South Africa is home to many strong global companies that don’t depend on the South African Economy. Additionally, South Africa is a much more reliable jurisdiction for resource companies than other African countries, in spite of weakness in the local economy. Companies connected to South Africa might be unfairly discounted for non-economic reasons. These factors