September hasn’t been too kind to Getty Realty (NYSE:GTY), as the shares have declined by 11% since the start of the month. Undoubtedly, fears of another surge in COVID-19 have weighed on the share price. However, I believe the decline is largely unwarranted. In this article, I show why the shares are an attractive investment at the current valuation; so let’s get started.

(Source: Company website)

A Look Into Getty Realty

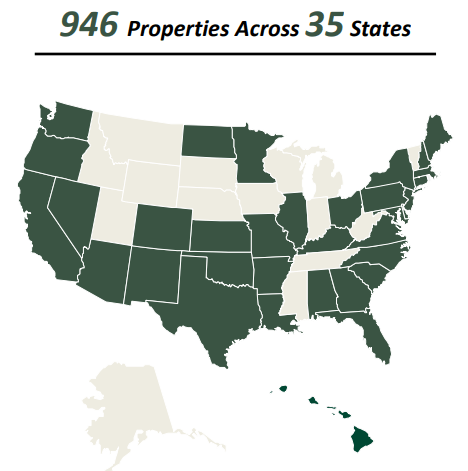

Getty Realty is a leading net lease REIT that specializes in the ownership of Gas Stations/Convenience Stores, and other automotive properties. It currently owns 946 properties that are spread across 35 states. As seen below, the properties well diversified, with exposure to much of the United States.

(Source: Company Earnings Presentation)

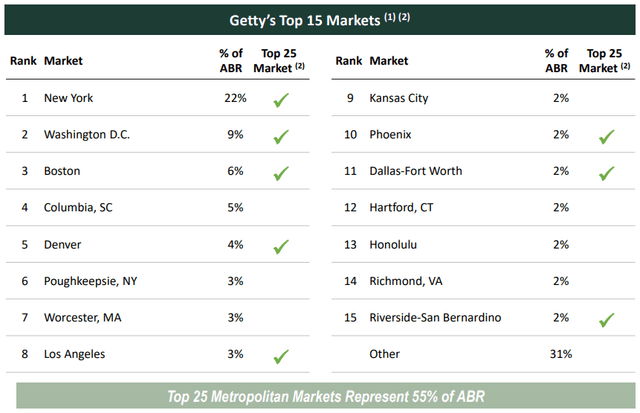

What I like about Getty Realty is the need-based products and services that its properties provide. Its properties are generally located in densely-populated, high-traffic areas. Currently, 55% of Getty’s ABR (average base rent) comes from the top 25 MSAs (metropolitan statistical area). This is further supported by the fact that 71% of its properties are at corner locations, which helps them to garner the most traffic. As seen below, New York City, Washington D.C., and Boston represents 37% of Getty’s ABR on a combined basis.

(Source: Company Earnings Presentation)

Despite headwinds from COVID-19, the portfolio occupancy remains very strong at 99% (unchanged from the same time last year), with a weighted average 10-year lease term. What I also find encouraging is that the unit level rent coverage actually improved on a YoY basis, to 2.3x in the latest quarter, which is up from 2.2x in the prior year quarter.

Rent collection appears to be manageable, as the company received 96% of its rents in the last quarter, with just 2.3% of its rents being deferred on a short-term basis. In addition, the company continues