Despite the decline of the global remittance market this year, Western Union (NYSE:WU) will be able to continue to create shareholder value for years to come. I believe that the downside of opening a long position in the company at this stage is limited since all the risks are already priced in, and the company has several catalysts which will help it to improve its bottom line in the foreseeable future. Since there’s already an indication that Western Union’s business is recovering, I decided to buy the company’s shares and plan to hold it for a considerable time.

Solid Company to Own For the Long Term

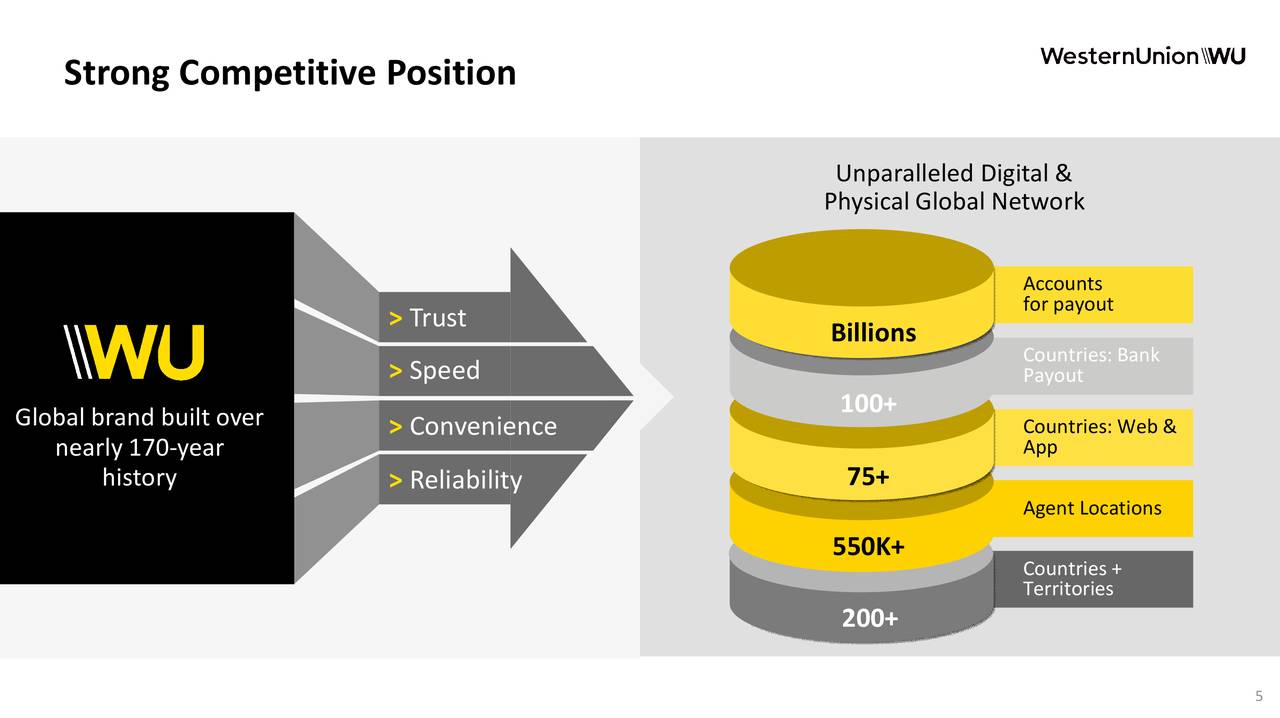

Western Union is one of the largest cross-border remittance companies in the world. For nearly 170 years, Western Union has been successfully transferring money between its clients around the globe, and its business continues to make profits to this day. The company has survived the Great Depression, two World Wars, the Cold War, numerous market crashes, and technological disruptions, and it’s still able to create value and reward its shareholders along the way. Currently, Western Union has one of the most sophisticated online and offline networks for transferring money around the world, and there’s every reason to believe that it will continue to be a dominant player in the payment industry.

Source: Western Union

The problem is that Western Union has a lot of physical locations across the globe, and as a result of lockdowns, its top-line suffered in Q2. From April to June, the company’s revenue declined by 17.2% Y/Y to $1.11 billion, but the company still made a profit, as its non-GAAP EPS was $0.41. In addition, just like MoneyGram (MGI), Western Union experienced a rise of digital transfers, as its Q2 digital revenue was up 48% Y/Y to $219 million.

The