So far, the SPDR S&P 500 Trust ETF (NYSEARCA:SPY) has had a normal correction after an enormous move up from the bottom of a market crash to a rather surprising new high. This move was fueled by extreme fiscal and monetary stimulus. The latest stimulus package is stalled in Congress, and the market move up is also stalled. Interest rates are about as low as they can go. However, the Fed still has other tools to prevent a financial collapse. Congress will eventually pass the next stimulus package. The worst-case scenario sees the market only stabilized and testing the old high. The best-case scenario sees a breakout to a new high sometime next year.

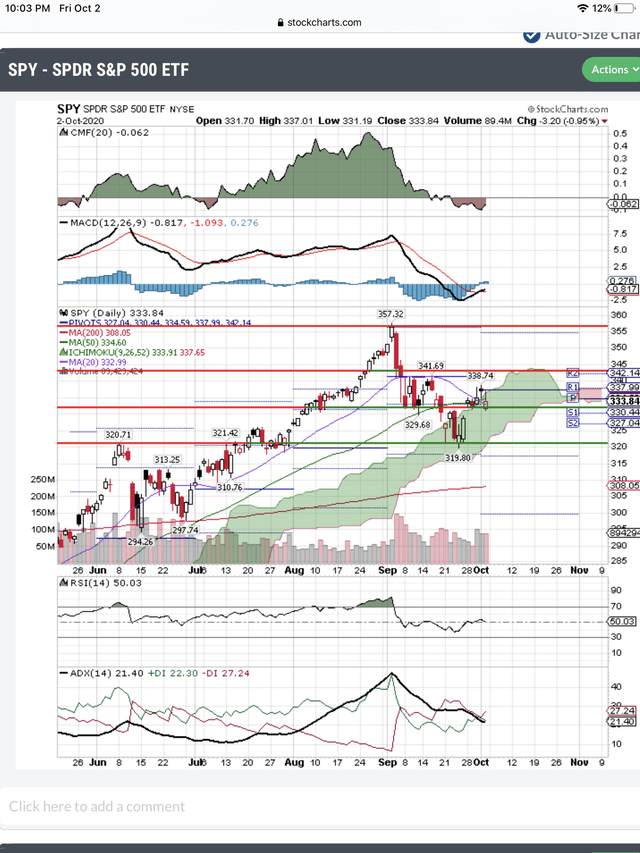

Here's the daily chart just to show the latest upside testing, its failure and now the move down to retest previous levels.

You can see the first test of $341 that failed and now the second failure at $339. On Friday, it closed at a $334 support level. The other signals are weak and were attempting to turn up before Friday’s bad news. You also can see the 20-day moving average breaking below the 50-day moving average, and I call this the “sick” cross. The death cross is the name given to the 50-day crossing below the 200-day.

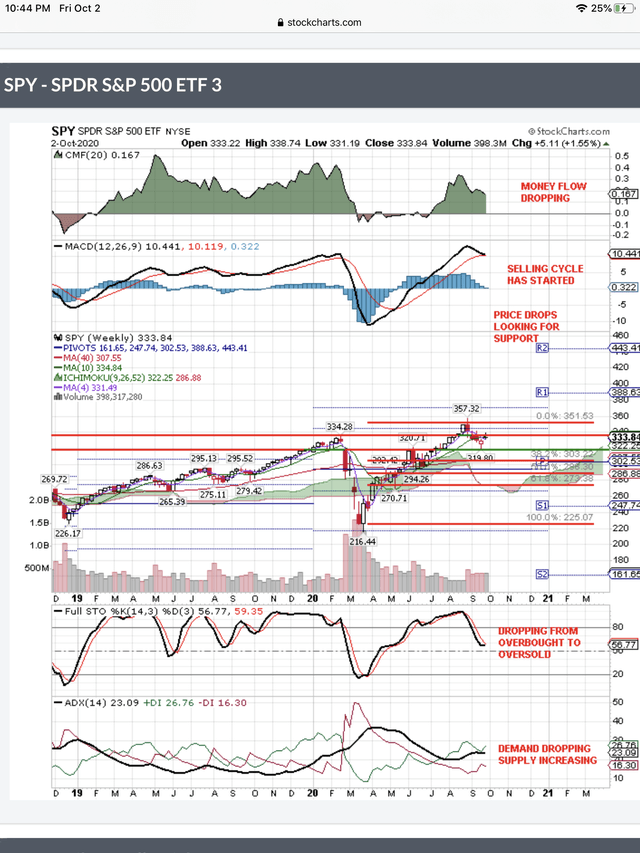

The weekly chart removes the daily gyrations and emotions and provides slower, but more reliable, signals for decision making about where SPY is going. Let’s take a look at it:

As you can see, all of the signals are down, just as you would expect during a correction in the market. You can see the break below the major, pre-COVID-19 high, support level at $334. The attempt to stay above that important level just failed. The next target seems to be a retest of the previous drop to $320.

Use our free, 30 day training program to become a succesful trader or investor.