The iShares U.S. Home Construction ETF (BATS:ITB) is on fire, up over 30% year to date. This is much more than a short-term move driven by speculation - the rally in ITB is built on solid fundamentals, and the ETF looks well-positioned for sustained gains going forward.

The Fundamentals Look Strong

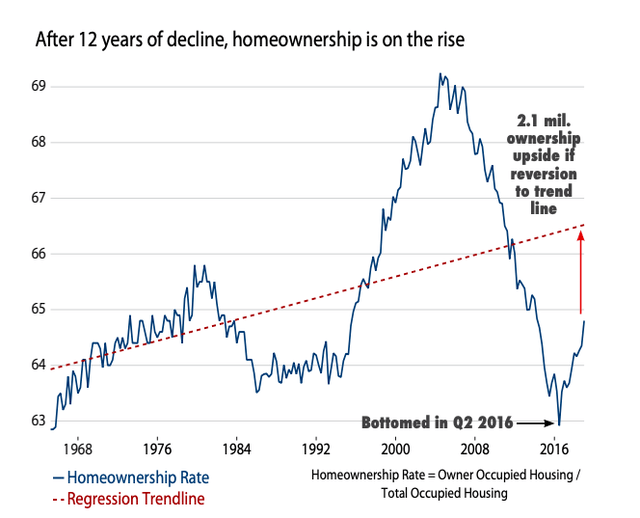

Before we try to understand the current situation in the housing market, it is important to understand where we are coming from. After the housing bubble exploded in 2008, housing starts have been well below average during the past decade.

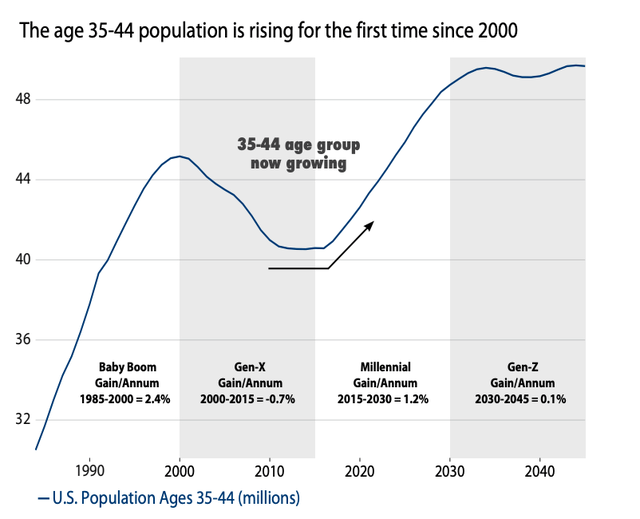

Markets generally work like a rubber band, and excess in one direction can lead to subsequent excesses in the opposite direction. It is not just that new supply has been below average for a long time, but demand is also set to explode higher due to the millennial generation entering their prime home-ownership age.

Source: Ned Davis Research

Source: Ned Davis Research

The global pandemic has caused a sharp recession, but it has also driven interest rates to historic lows. Authorities at the Federal Reserve have repeatedly said that they are planning to keep rates low for several years, and this obviously makes mortgage rates cheaper and houses more affordable.

In the words of Lennar (LEN) CEO Stuart Miller:

With historically low interest rates, and the production deficit that has defined homebuilding from the past decade, together with the limited inventory and short supply in the market, housing and especially affordable housing is and will continue to be an essential driver of the economy

It is not just about supply and demand dynamics. The pandemic is also making people increasingly conscious about the importance of the home, which is now also the office, the school, the gym, and the entertainment center. The pandemic is going to be over sooner or later, and life will go back

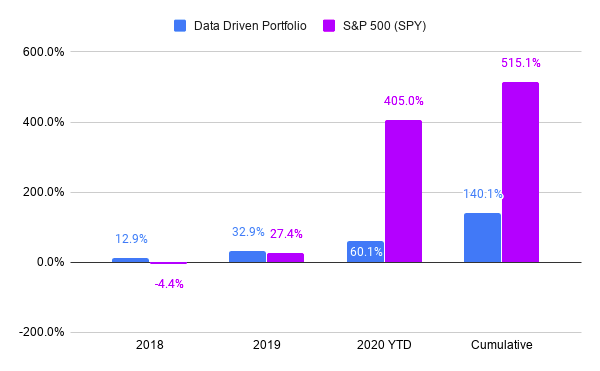

The Global Rotation Strategy is updated monthly in The Data Driven Investor. A subscription to The Data Driven Investor provides you with solid strategies to analyze the market environment, control portfolio risk, and select the best stocks and ETFs based on quantitative factors. Our portfolios have outperformed the market by a considerable margin over time, and they are built on the basis of solid quantitative research and statistical evidence. Click here to get your free trial now, you have nothing to lose and a lot to win!