Investment Thesis

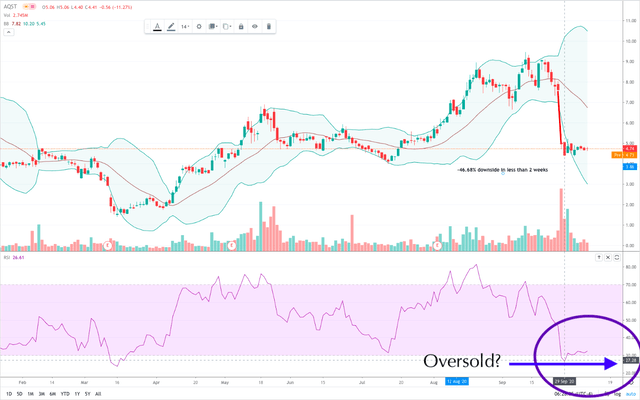

After a recent run-up since July to a high of $9.09 in mid-September, the market has punished Aquestive Therapeutics (NASDAQ:AQST) with a -46.86% change to the downside in around 2 weeks to today's trading of $4.74. The notable cause is cited as the FDA's rejection of AQST's marketing application for their Libervant Buccal Film (LBF), the compound of which claims its effectiveness in the management of seizure clusters. The issue, reported by the FDA, was that certain weight groups incorporated within the study filed with the LBF application did not show the pharmacokinetic responses intended with the indicated therapeutic dosages outlined. Therefore, the application was rejected, which resulted in a large selloff from September 25th until September 30th on enormous total volume of 29,225,943 shares over these 5 days. Shares rebounded very slightly by October, and RSI indicators suggested that at current levels the stock may be oversold and has the potential for momentum to change back to the upside.

Data Source: Trading View and Seeking Alpha

Looking at the charts, we have been in this similar situation 3 times over the past year with AQST, each with a favourable rebound back towards the $6-$8+ range from previous lows. Furthermore, the last 3 times in which prices approached and/or breached the RSI 30 line, large run-ups occurred where shorter-term investors who took profits early benefited greatly. To illustrate, the low as of 21st October, 2019, saw a 176.97% increase to a high of $8.78 by December 2019; in March this year, we reached a post-selloff low of $1.54 before the bulls gained confidence and drove trading to a 247% increase to $6.82 in May; and as recently as July, after a bearish sentiment where investors saw a quarterly low of $4.17, AQST bounced back in a 106.95% increase to $8.63 in mid-September.