The Stone Harbor Emerging Markets Income Fund (NYSE:EDF) is a closed-end fund that invests in "EM" sovereign debt, corporate bonds, and related derivatives. This is a market segment that has disappointed over the past decade given tepid economic growth further impacted by this year's COVID-19 pandemic. Recognizing what has been a challenging year for the EDF fund with its net asset value down about 12% year to date, and an even deeper decline at the share price considering a widening discount to NAV, we think the underlying portfolio offers value at the current level. EDF's 14.6% yield distributed through a monthly payout represents an attractive income opportunity supported by improving macro conditions for emerging markets.

(Source: finviz.com)

Background

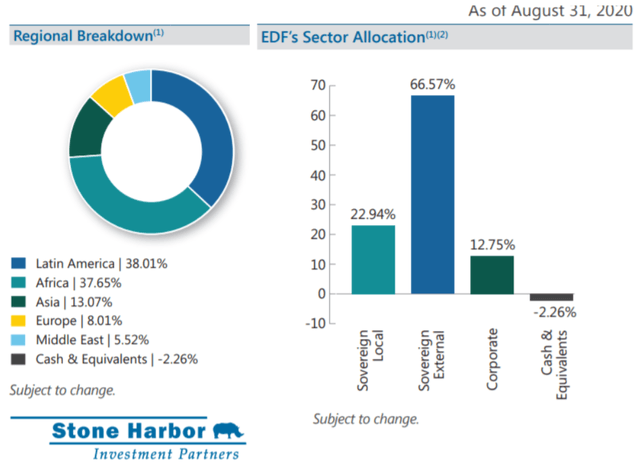

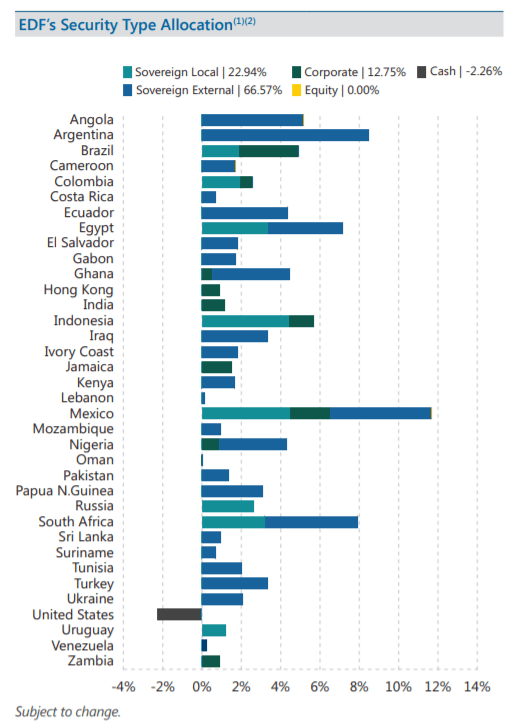

EDF invests primarily in sovereign bonds which represent 90% of the asset allocation across local and external debt. These securities are issued by foreign governments and reflect a country's obligation to repay debt either in the domestic currency or issued in foreign currencies like the U.S. dollar or euro. Separately, over 75% of the fund's exposure is based on U.S. dollar-denominated debt which limits the inherent FX risks related to foreign investments. Based on the latest disclosed holdings, EDF invests in a wide range of emerging markets with a 38% concentration in the Latin America region. Mexico with a 12% weighting represents the largest country exposure, followed by Argentina and South Africa each at 8%.

(Source: Stone Harbor)

What's important here is that while the term "emerging markets" is a broad market segment in its own right, EDF underweights Asian emerging markets and developing countries relative to global benchmarks. Notably, China is not included as an emerging market country in the fund, although there is a small position in Hong Kong-related corporate securities.

(Source: Stone Harbor)

In terms of direct exposure to

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.