Ball (BLL) recently hosted a very upbeat virtual investor day, with plenty to be bullish about on the growth front. The messaging focused on aluminum beverage can growth, as well as opportunities in cups and sustainability tailwinds. Given the robust can demand outlook, the company will be making significant capex outlays in the coming years, which is positive if it can sustain ROIs anywhere near target.

BLL stock is at new highs, but if it delivers on its promises, I see an asymmetric risk/reward opportunity over the medium term. On balance, I think the current valuation premium to packaging peers is warranted, and BLL will continue to compound at impressive rates for the years to come.

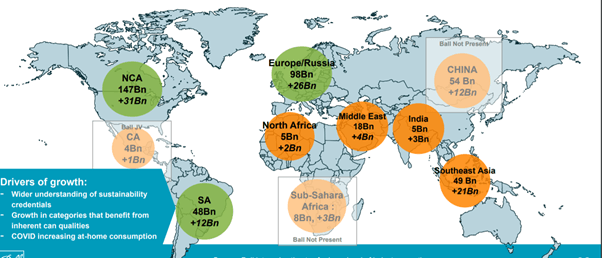

The >100bn Global Beverage Can Opportunity

One of the numbers that stuck out most from the presentation was the >100bn demand projection off 2019 levels for the industry. Regional growth projections are as follows - North and Central America (+ ~31bn units), Europe (+ ~26bn units), South America (+ ~12bn units), and Southeast Asia (+ ~21bn units). This translates into annual volume growth projections across regions as follows - +4-6% in North America, +5-8% in South America, and +4-6% in EMEA to 2025. Given Ball holds the largest market share in the US, Europe, and South America, it looks very well-positioned to capture the overall growth opportunity.

Source: Investor Presentation

The ~10bn Can Shortage

This year alone, the US is short ~10bn cans - for perspective, this is equivalent to ~9% of the entire 2019 market. With no signs of the shortage abating anytime soon, imports will need to continue into 2021 and perhaps even into next year's peak summer selling season. In any case, expect the supply/demand balance to remain tight.

Plus, the company also made a case for the COVID-19-driven boost turning structural - per