The commercial mortgage REIT sector remains challenged, with the larger players trading well below where they were at the start of the year. In this article, I’m focused on Starwood Property Trust (NYSE:STWD), whose share price has declined by 37% on a YTD basis. I believe the stock has been overly punished, and evaluate what makes it an attractive investment. So, let’s get started.

(Source: Company website)

A Look Into Starwood

Starwood Property Trust is a leading commercial mortgage REIT that specializes in commercial, infrastructure, and residential lending. It’s also somewhat unique in that it also owns property as an equity landlord as well. Since inception, Starwood has deployed nearly $64 billion of capital, and its current portfolio is comprised of $17 billion spanning the aforementioned sectors. It is led by its long-time CEO, Barry Sternlicht, and the senior management team averages 15+ years with the company and 26+ years of industry experience.

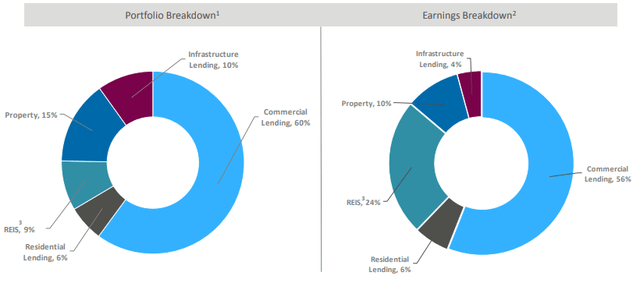

As seen below, commercial lending makes up the bread and butter of the business, with a 60% share of the overall portfolio, followed by the owned-property and infrastructure segments, which make up 15% and 10%, respectively.

(Source: October Investor Presentation)

In the commercial lending segment, Starwood would typically originate a loan with a first mortgage. It then carves out that first mortgage into senior and junior tranches. The company then finances or sells the senior tranche and retains the junior tranche of the loan. In the case of financing the senior tranche, Starwood earns the spread between the yield on the asset and the cost of financing.

As for most commercial mortgage REITs, the current macroeconomic environment poses unique challenges. One of the continued risks that I see for Starwood is its exposure to Hotels, which comprises 23% of its Commercial lending segment (13.8% of the total portfolio). However, I do see adequate buffers in