Stock Spike

Medalist’s stock price soared on Wednesday for a triple digit gain after the company was pumped in after hours trading Tuesday. The stock price change appears to have little to do with any fundamental change in the company or positive results, but traders seeking to pump the stock price higher and sell after making a quick gain.

The strategy enacted is known as a gap and run. After the stock price spiked in after hours, traders rushed into the stock in the early morning hours. The stock spiked from as much as $1.18 per share at close Tuesday to over $6 per share mid-day Wednesday. Since then, the stock price has come back down to $2.85 per share.

What Prompted the Spike?

MDRR declared a $.50 per share preferred dividend on Tuesday. The company provides occasional press releases on business updates and dividend declarations. MDRR’s preferred dividend declaration does nothing to change the fundamental value of the company. However, speculative “pump and dump” traders appear to have capitalized on the news by promoting the company as a buy.

Such is done rapidly in trading chat rooms, email lists, and social media activity. By distributing the news that the company is a buy to followers, traders bid the stock price up significantly. There are no major leases signed, acquisitions made, or apparent buy out rumors that indicate such an increase in the stock price is warranted.

Portfolio Overview

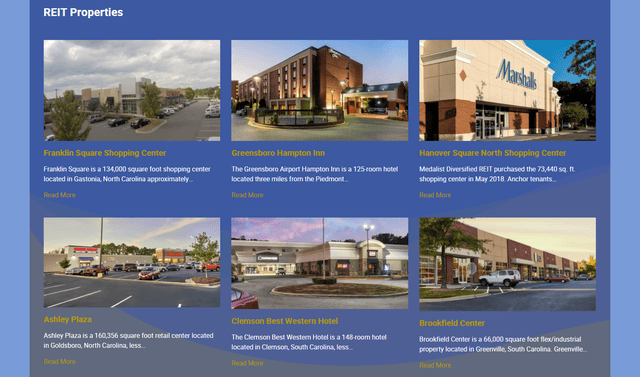

Medalist currently owns six properties, including three retail shopping centers, two hotels, and a flex industrial property. The company operates exclusively in the Southeast region, and their current properties are located in North Carolina, South Carolina, and Virginia.

The company struggled immensely after going public, and covid has accelerated company challenges. Rent collection levels were down, and hotel