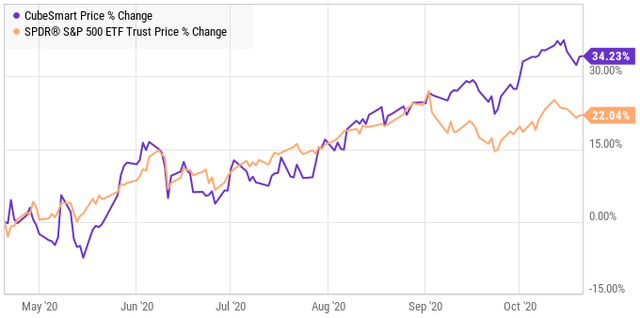

CubeSmart (NYSE:CUBE) has done well over the past six months. As seen below, its share price performance has beaten that of the S&P 500 (SPY) by 12%, with a 34% six-month return based on share price appreciation.

(Source: YCharts)

While other REIT sectors are still reeling from the effects of COVID-19, the self-storage industry has largely weathered this storm well. In this article, I evaluate what makes CubeSmart a good addition to an investment portfolio, and whether if the shares are an attractive buy today; so, let’s get started.

(Source: Company website)

A Look Into CubeSmart

CubeSmart is a self-storage REIT with over 400 owned properties and over 700 non-owned managed properties. While CubeSmart is smaller than its peers Public Storage (PSA) and Extra Space Storage (EXR), there are ample opportunities for it to grow. According to the 2020 Self-Storage Almanac, CubeSmart is one of the top three owners and operators of self-storage properties in the United States. I see plenty of opportunities for the top operators to consolidate this sector, which consists of approximately 48K properties in the U.S., of which the top 10 operators collectively own just 24%.

The resiliency of CubeSmart’s business model is demonstrated by its profitability during a difficult macroeconomic environment. For the second quarter, CUBE reported $0.41 FFO/share, which is nearly flat compared to the $0.42 FFO/share that it reported for Q2’19. This represented a slight, 2.5% sequential QoQ increase. I see this as being an encouraging sign that CUBE will be able to weather additional economic challenges from COVID-19, as we enter the fall and winter seasons.

Looking forward to Q3 results, I expect to see a slight improvement over Q2 results. This is supported by the positive results that the company has seen earlier in the quarter. For the month of July, same-store vacates were down