Alphatec Holdings, Inc. (NASDAQ:ATEC) or "Alphatec" is a medical technology company that designs, develops, and advances technologies for the surgical treatment of spinal disorders.

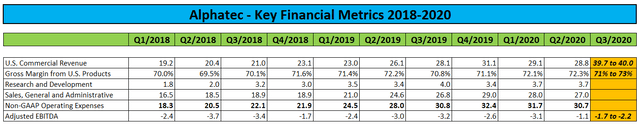

After selling its international operations to competitor Globus Medical (GMED) in 2016, the company experienced initial difficulties to reinvigorate its U.S. sales pipeline. But, over the past couple of quarters, Alphatec has been making good progress and even managed to grow first half revenues by 18% year over year despite the severe challenges presented by COVID-19. Before the pandemic hit, the company's year-over-year sales growth had increased to almost 35% in Q4/2019.

Slide: Recent Product Releases - Source: Company Presentation

Blowout Q3 Preannouncement

Two weeks ago, the company released surprisingly strong preliminary third quarter results, with year-over-year growth accelerating to 42% at the mid-point of the guided range, the highest level witnessed over the past decade.

Preliminary, unaudited third quarter 2020 results are expected to reflect U.S. revenue growth of 41% to 43% compared to third quarter 2019. Growth was driven primarily by the continuing rapid adoption of recently released ATEC technologies and strong pull-through from the SafeOp Neural InformatiX System. New product sales represented over 70% of estimated U.S. revenue for the quarter.

Total revenue is now expected to come in between $40.7 million and $41.1 million with $39.7 to $40.0 million contributed by the core U.S. business. Analysts, on average, were expecting just $31 million. New product sales increased to 70% of U.S. revenues, up from 61% in Q2 and 42% in Q3/2019.

Source: Company Press Releases

The huge upside surprise sent the shares soaring by almost 40% with additional gains recorded in subsequent sessions. At their peak, the shares were up 65% from the October 6 closing price.

Capital Raise Removes Balance Sheet Overhang

The blow-out quarter actually paved the way for a