At first glance, you’d think that Getty Realty (NYSE:GTY), a net lease REIT of gas station properties, would be struggling during a pandemic that has dramatically reduced car travel across the country. The reality could not be further from the truth, as GTY has experienced minimal impact from COVID-19, at least as far as rent collection is concerned. GTY was able to report 9.3% AFFO per share growth in the latest quarter, and on the backs of strong results even raised the dividend by over 5%. GTY maintains a low leverage balance sheet which helps to compensate for any potential secular headwinds facing the gas station segment. With shares yielding in excess of 6%, shares are a buy.

The Resiliency Of Gas Station Net Leases

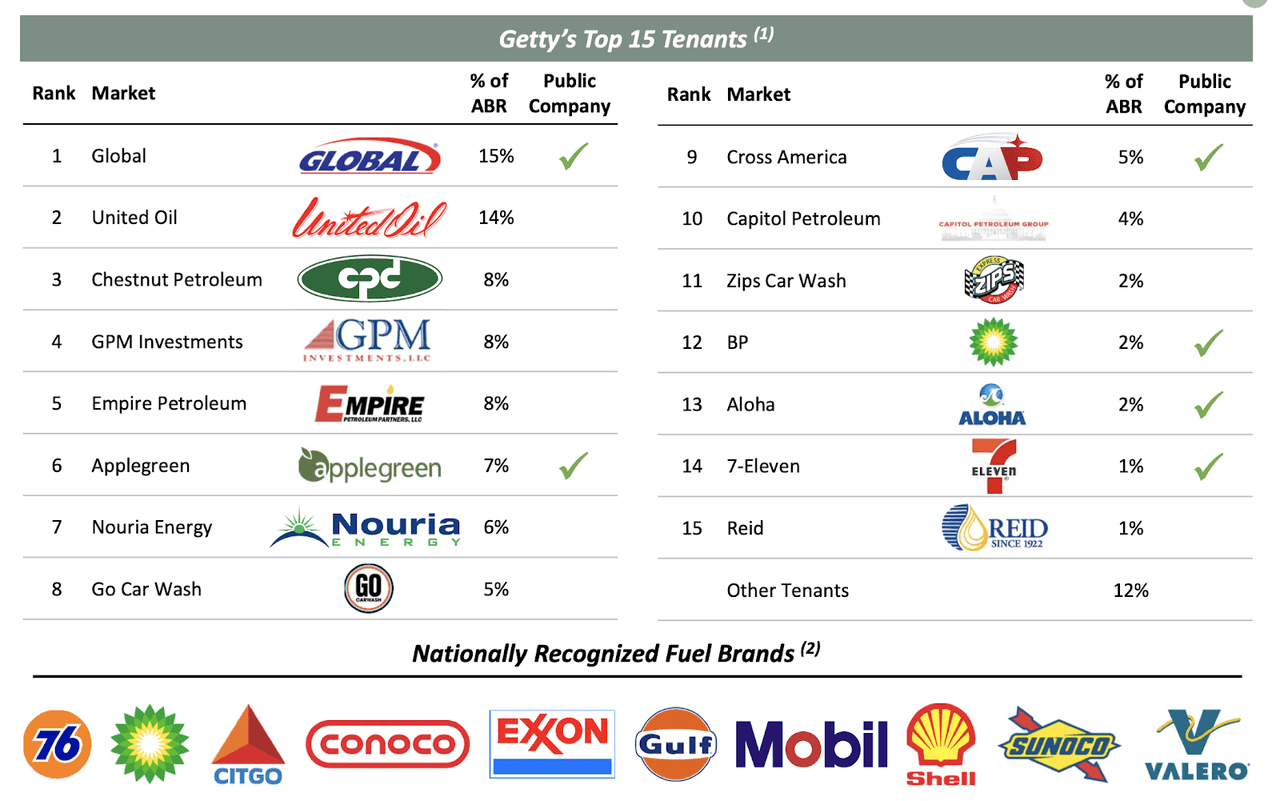

When you look at the tenant list below, what do they all have in common?

The better question might be, what’s the difference? GTY is a pure-play on gas station net lease properties, which at first might sound like exactly what you do not want to own during a pandemic. It turns out that in spite of people staying at home, GTY has been able to produce strong results. Whereas net lease REIT peers have seen rent collection rates dip significantly in the past several quarters, GTY has not seen rent collection dip below 96%, and rent collection was 98% for the month of October. GTY has even been able to grow AFFO per share by 6.2% year to date.

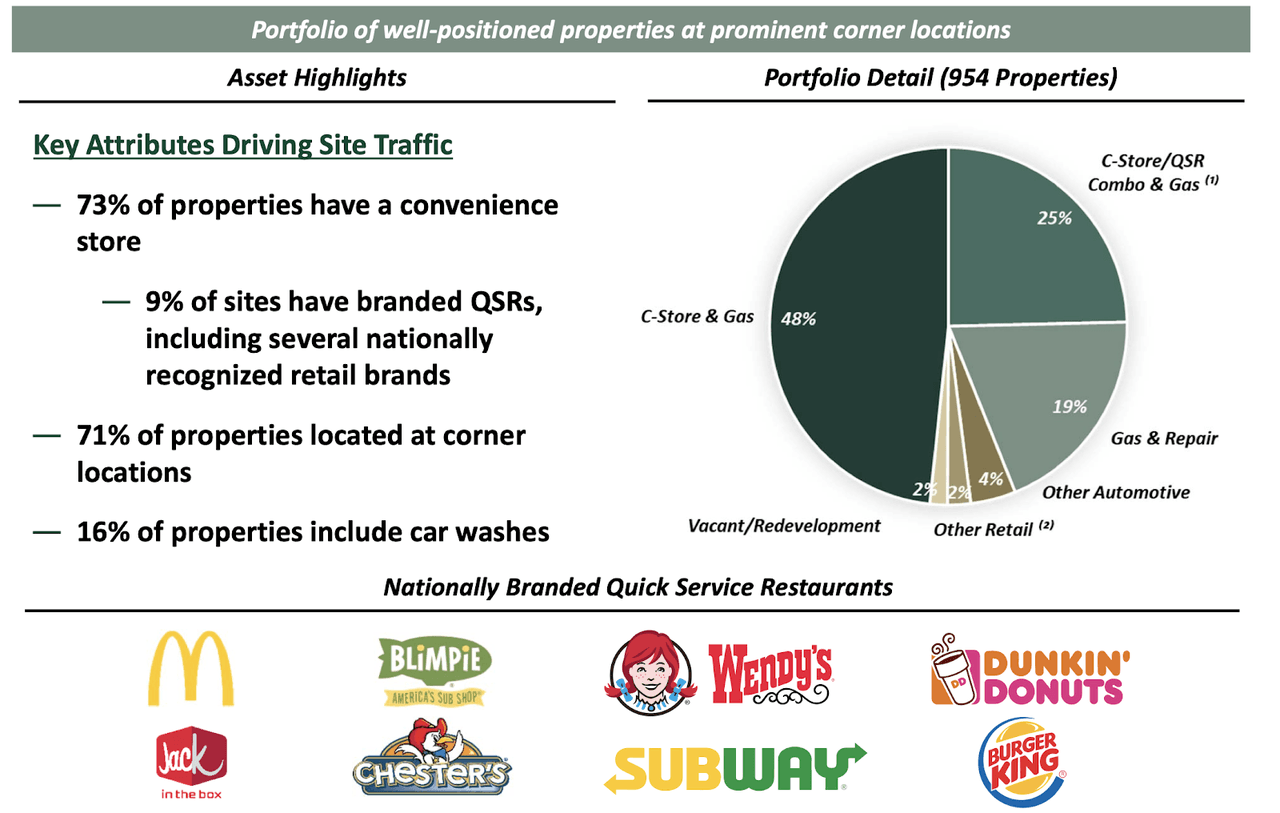

Aren’t gas stations struggling? Perhaps many gas stations are reporting lower profits from fuel sales, but many of GTY’s tenants include a convenience store component:

Readers may be surprised to learn that gas stations derive the majority of profit from their convenience stores, as convenience store margins have remains steadily strong over

Discover More High Conviction Ideas

NNN REITs are one of my 8 high conviction ideas. Subscribers to Best of Breed to get access to my top 10 holdings and full access to the Best of Breed portfolio. Exclusive Best of Breed content includes industry deep-dives, new compelling ideas, and high conviction picks.

Ignore the noise. Avoid bubbles. Stick to high quality and buy Best of Breed.