Automatic Data Processing (NASDAQ:ADP), referred to as ADP from here on, is a global leader in payroll and human resources outsourcing. At the end of FY 2020, ADP had >680k clients worldwide with options supporting freelancers up to Fortune 500 companies.

The value proposition for ADP's clients is that by outsourcing the rather mundane tasks of running a business, i.e. payroll, HR, etc., management can focus on the things that are truly important to improving the business over time.

ADP is one of those chronically expensive businesses that I had long refrained from adding to my portfolio. Roughly one year ago, I finally initiated a position and have been slowly building up my stake since then.

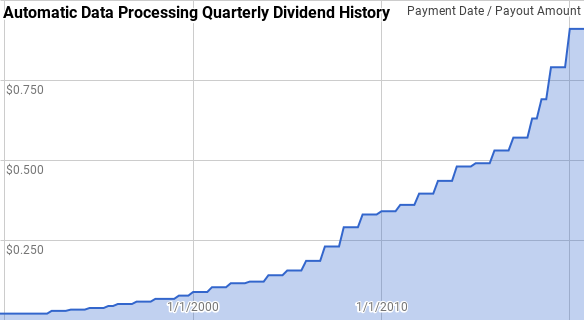

Dividend History

The investment strategy that I gravitated towards most is dividend growth investing. By adopting that strategy, I want to build my portfolio with businesses that generate plenty of excess cash flow that can then be returned to owners via a rising dividend payment.

Image by author; data source Automatic Data Processing Investor Relations

Image by author; data source Automatic Data Processing Investor Relations

According to the CCC list, ADP is a Dividend Champion with 44 consecutive years of dividend growth. That puts its streak starting back in 1976, and every year, ADP has been there rewarding shareholders with pay raises throughout all sorts of economic and political cycles.

Starting with 1991, ADP has shown year-over-year dividend growth ranging from 3.6% to 33.0% with an average of 14.3% and a median of 14.8% across those 29 periods.

Of the 25 rolling five-year periods over that time, ADP has shown annualized dividend growth between 7.6% and 21.0% with an average of 13.4% and a median of 13.4%.

There's been 20 rolling 10-year periods over that same time where ADP has an annualized dividend growth ranging from 8.8% to 18.1% with an average of 13.3% and a median