Introduction

Ally Financial (NYSE:ALLY) is a leader in the digital financial services industry. The bank offers products ranging from deposit banking, insurance, mortgages, auto loans, and investment services. Ally Financial has seen its stock price decline this year along, with many other banks. Although the bank has seen some headwinds as a result of the COVID-19 pandemic, the overall financial well being and performance are still good. This is unlike many other financial institutions that have seen heavy losses over the same period. I am thinking about starting a position in Ally Financial because of the solid financials, positive industry trends, and a low price-to-tangible book value of 0.84x.

Long-Term Overview

Company Overview

Source: SEC 10-K's

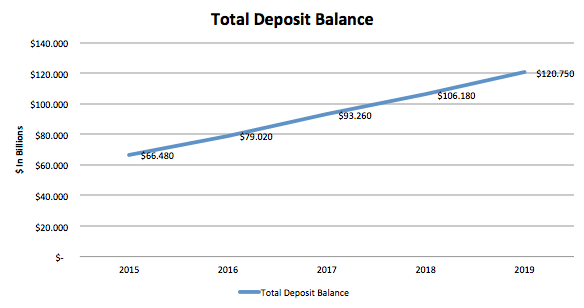

Before getting into the financial performance of Ally Financial, I wanted to explain what I like about the business model. Ally Financial has a strong focus on being consumer-centric with exceptional customer service and product innovation directed for the customer. The bank has a motto of "doing it right" and a six-point strategic overview on how to achieve this goal. These strategic points of focus are to differentiate around the customer, optimize auto, and insurance business lines, grow total customers and deposits, expand product offerings, deploy capital efficiently with proper risk management, and ensure the culture is aligned for the customer. Strategic points two through five are commonplace business goals, but I like how the company purposely wrapped them around the customer goals. This focus on the customer has helped and will continue to help grow the deposit base, therefore, helping the bank grow revenue over the long term.

Financial Overview

Source: SEC 10-K's

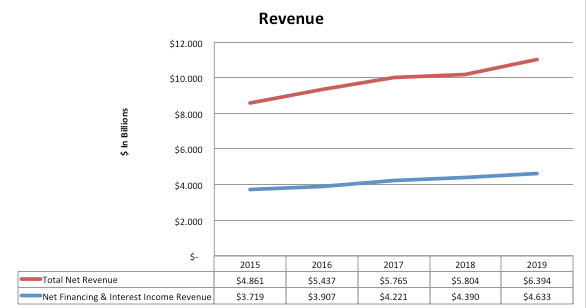

Ally Financial has seen a total revenue growth rate of 5.64% over the past five years. As can be seen, this growth was powered by net financing and interest income, which grew at a