Investment Thesis

Denison Mines (NYSE:DNN) sold off significantly in the beginning of the year like the rest of the uranium industry. The stock recovered from April and onwards, but has recently sold off again primarily due the upsized bought deal financing and delays related to covid-19.

Figure 1 - Source: YCharts

The stock price has been punished excessively in my view and I recently took a position in Denison. Like the rest of the industry, it is to some extent dependent on a recovery of the price of uranium, but the stock now offers a very attractive upside for the patient investor.

Bought Deal Financings

Denison was running low on cash earlier this year and announced a bought deal financing around the lows in March. While the size was relatively limited, 28.75M shares, the price of $0.20 was extremely frustrating for existing shareholders.

Figure 2 - Source: YCharts

The most recent bought deal was larger with 51.35M shares at $0.37, which provided the company with $19M. The size was initially announced for $10M and some investor raised criticism over the increased size, but I can certainly understand that the company would like to do anything it can to avoid a similar situation it experience earlier this year.

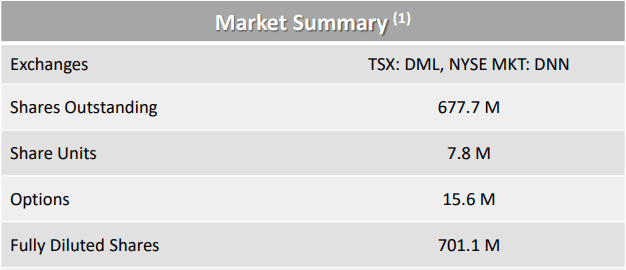

Market Cap

Using the most recent share count from the corporate presentation, Denison had 701.1M fully diluted shares. With the current stock price $0.32 the market cap is consequently $224M. Note that Denison doesn't have any debt and has C$29M ($22M) in cash as of the most recent update.

Figure 3 - Source: October Corporate Presentation

Business

The better part of Denison's value comes from the 90% ownership in the Wheeler River uranium project. The company also derive some revenues from management of Uranium Participation Corp, Closed Mines Operations, and has a 22.5% interest