India has more than its share of problems. It's had one of the worst COVID-19 outbreaks in the world, and its economy, highly dependent on migrant laborers, was devastated by lockdowns. Yet several major economic reforms are likely to improve the business environment. Additionally, changes to foreign ownership restrictions will drive more passive inflows into the stock market, providing support regardless of economic fundamentals. This setup has important implications for investors in the iShares MSCI India ETF (BATS:INDA).

COVID-19

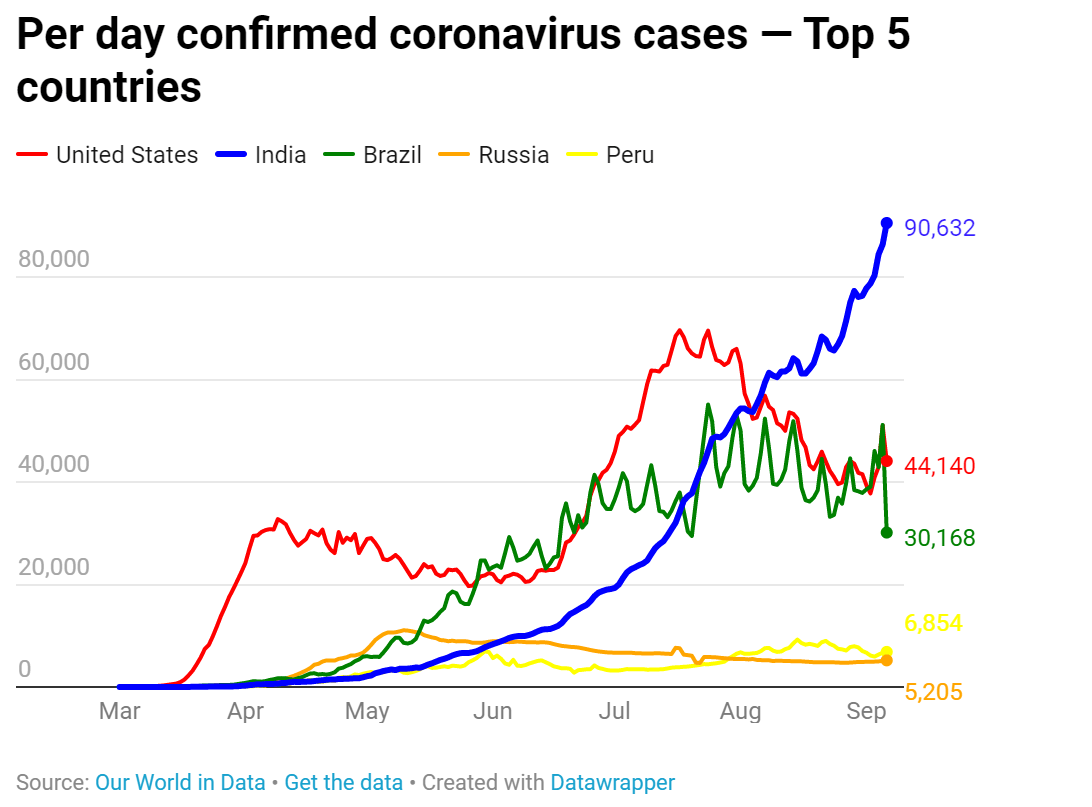

India recently surpassed Brazil to become the country with the second largest number of COVID-19 cases. And the total underestimate reality because India has been slow to ramp up testing.

This chart shows how India has experienced a surge in coronavirus cases:

Source: Times of India

Containing the virus in India has been exceptionally difficult. The initial lockdown order proved to be a disaster in which migrant workers crowded on to trains in an attempt to return to their hometowns as the outbreak was starting. This led to a more widespread outbreak. Worse yet, some migrant workers ended up stranded away from home. The government failed to provide support medical and economic support for workers dependent on daily wages.

In the second quarter of this year, India's GDP contracted 23% year over year. The IMF is projecting a 10.3% contraction in Fiscal year 2020. This is far worse than the -1.7% contraction expected from emerging markets as a group. However, the IMF does expect the economy to recover in 2021 and grow at an 8% rate. More importantly recent economic reforms will soon start to have an effect.

Economic Reforms

Prime Minister Modi has been pushing a reform agenda that could drastically transform the Indian economy. These changes could improve the long run growth trajectory, although they will cause short term disruption. A