Thesis

T. Rowe Price Group (NASDAQ:TROW) is a Dividend Aristocrat with no debt and a very strong track record of rewarding shareholders through growing dividends and buybacks.

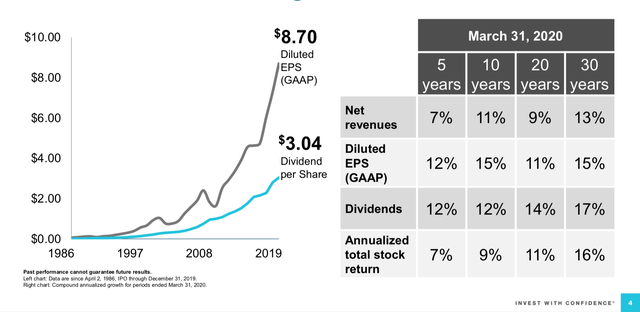

As seen on the image below, dividend growth is supported by strong growth in business performance.

Source: T. Rowe Investor Presentation

The Company

T. Rowe Price Group is a Baltimore-based asset manager with more than $1.3 trillion in assets under management. The company offers a wide variety of mutual funds, investment management, advisory and financial planning services to individuals and institutions alike.

T. Rowe focuses on actively managed funds and has managed to grow the assets under management from around $400 billion in 2010 to $1.3 trillion as of September 2020.

Importantly, to income investors, TROW is a Dividend Aristocrat with a very impressive dividend growth streak of 34 years.

Source: T. Rowe Price Investor Relations

Dividend

TROW offers a dividend that's a strong mix of yield, growth, and safety.

The current dividend is yielding 2.84%.

Dividend payouts have grown at an impressive compounded annual growth rate of 13.5% over the last 20 years, with the latest raise coming in at 18.4% at the start of the year.

In current uncertain times, TROW can still very comfortably cover its dividend payments with a 39% earnings payout ratio.

A track record of 34 years of consecutive dividend raises further re-assures investors on the company's commitment to rewarding shareholders through growing dividend payments.

Balance Sheet

The company is debt-free. TROW also has substantial cash reserves on the balance sheet. This has allowed them to opportunistically buy back shares at an attractive price, creating shareholder value as a result.

In the first 9 months of 2020, TROW has reduced the share count by 4.6%. The average price for those repurchases was $108.7.

The strength of the