Introduction

This year I have been keeping an eye on regional banks. Although they obviously aren’t as well-diversified as the major banks, one could argue they are able to limit their risks by knowing their core markets due to the local focus. Timberland Bancorp (NASDAQ:TSBK) has just completed its financial year 2020 and despite the COVID-19 pandemic, this local bank in Washington State with just a handful of branches around Seattle reported the 10th net profit increase in a row.

Timberland’s net income increase in FY 2020 is remarkable

Timberland’s financial year ends in September, so the most recently reported financial results of the small regional bank are the full-year results of FY 2020.

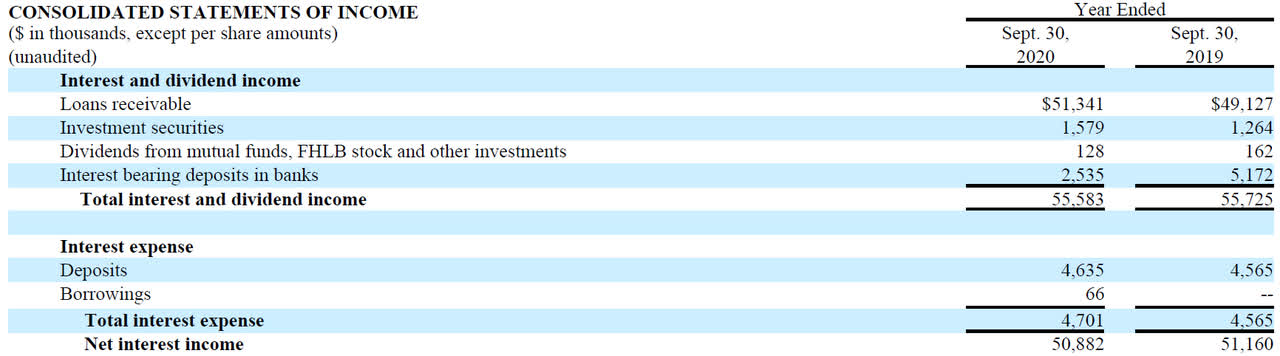

The bank reported a very small decrease in interest income (less than 0.5%) while the interest expenses increased by a same marginal percentage. This caused the net interest income to decrease by around half a percent to $50.9M. Hardly a disaster, but it’s an interesting development to see the interest expenses increase.

Source: Company press release

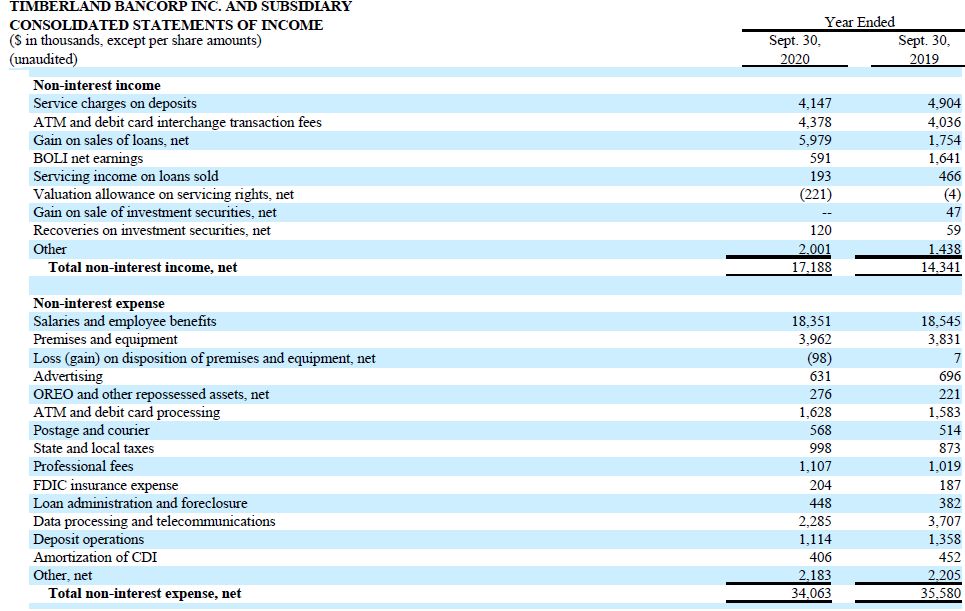

What really helped Timberland in FY 2020 was the strong decrease in the net non-interest expenses. As you can see below, in FY 2019, Timberland spent $35.6M in non-interest expenses while generating $14.3M in non-interest income for a net non-interest expense of around $21.3M.

In FY 2020, we see the non-interest expenses decreased by around 4% to $34.1M while the non-interest income increased to $17.2M, resulting in a net non-interest expense of just around $17M, a decrease of $4M.

Source: Company press release

That’s what really pushed Timberland over the edge, allowing it to record a slightly higher pre-tax income of $30.3M (compared to $29.2M) despite the $3.7M loan loss provision ($0 in FY 2019). However, investors should realize some of the non-interest income may be non-recurring. We notice a $4.2M increase in the gain on the sale of loans and

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!