Lots of things are going on right now. Time is scarce. So, I'm going to make this easy. Four points about Farmer Mac (NYSE:AGM), my favorite stock:

- It just reported another excellent quarter.

- It trades like a bank, but on most key measures, it is better than a bank.

- The three reasons why it can consistently deliver strong earnings and dividend growth.

- How cheap this stock really is.

Farmer Mac reported another excellent quarter

Here are the highlights:

Operating EPS was $2.57, up 18% year-over-year (YoY). Operating EPS year-to-date is $6.88, putting Farmer Mac comfortably on its way to earning over $9 per share this year.

The core interest margin was 96 bp, over Farmer Mac's target of 90 bp. Farmer Mac benefited from the Federal Reserve's low interest rates, unlike the banks (see below). It is also focusing more on higher-return assets like farm mortgages and rural alternative energy loans, as opposed to loans to other farm lenders.

Chargeoffs (actual loan losses) were $0. That's right, zero. Nada. They have totaled only $400,000 year-to-date, or about 2 bp. Find another lender that low. It probably doesn't exist.

Operating expenses were 25.6% of revenues, down from 28.2% a year ago. Farmer Mac says not to expect improvement ahead, but like a lot of companies, it cancelled a lot of travel, etc. due to COVID-19.

Preferred stock dividend cost common shareholders $0.48 per share versus $0.32 the prior year. Farmer Mac issued two preferred stocks this year just to be super-cautious and finance more growth.

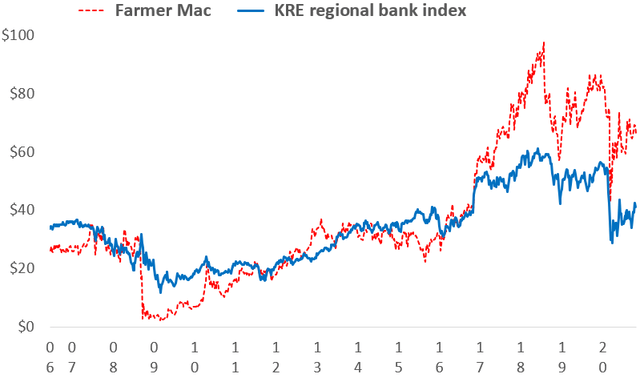

Farmer Mac trades like a bank, but on most key measures, it is better than a bank

This chart compares Farmer Mac's stock price to regional bank ETF KRE.

Source: Yahoo Finance

The correlation is remarkably close - an R² of 85% since 2006. So, investors firmly place Farmer Mac