Duke Realty Corp. (DRE) shares did not react well to the news of a vaccine on November 9th, as the share price fell by nearly 5% from the end of trading on November 8th to end of trading on November 9th. Apparently, Wall Street believes that the end of the pandemic would harm Duke Realty’s growth prospects. In this article, I show why this may not be the case and what makes it an attractive long-term investment. So, let’s get started.

(Source: Company website)

A Look Into Duke Realty Corp.

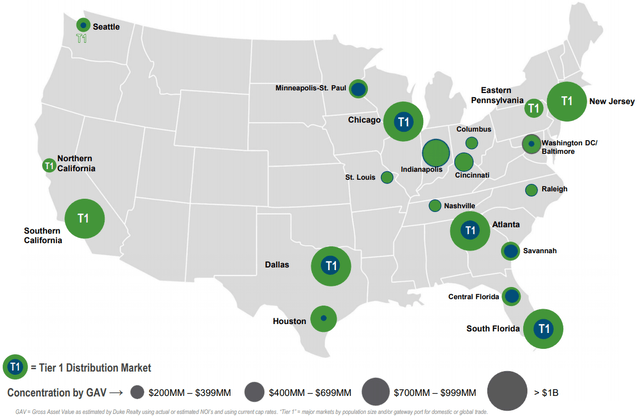

Duke Realty Corp. is a self-managed REIT that has a rather simplistic business model of owning and managing U.S. industrial assets. It has over 800 tenants, and 156 million of gross leasable space across 518 properties. Duke Realty is also a member of the S&P 500 and has a 25+ year history as a public company. As seen below, it’s well-diversified geographically, with a presence in 20 markets. By 2021, management expects that 70% of its geographic focus will be on Tier 1 markets.

(Source: September Investor Presentation)

Duke had a rather strong Q3, with a revenue beat and FFO/share that was in line with analyst expectations. Revenue grew by 8.6% YoY, and importantly, Core FFO per share grew by 8.1% YoY, from $0.37 in Q3’19 to $0.40 in the latest quarter. The rent collection rate also remained very strong with a 99.9% collection rate for the third quarter, and portfolio occupancy remained strong at 95.6%.

I’m also encouraged to see that same-property NOI grew by 5.0% YoY during Q3. This is far higher than the pace of inflation and tells me that Duke Realty is benefiting from favorable supply and demand characteristics in its markets. Looking forward, I see strong external growth prospects for the company. This is supported by the four development projects