The pandemic and associated lockdowns have had a devastating impact on the global economy, in truly unthinkable ways. Many aspects of our culture and society such as New York city mass transit for instance, or normal toll road traffic, has been thoroughly disrupted with this new, and in my opinion, distorted way of life. This has been a very unfavorable environment for value and financial stocks, including Assured Guaranty (NYSE:AGO), which is the leading bond insurance company. We would be silly to not acknowledge that the playing field has changed, but it is not all for the worse for the company. New business production growth, strong capital allocation, and a continuously improving balance sheet lead me to believe that the best days are ahead for equity owners.

Source: AGO 3rd Quarter 2020 Earnings Presentation

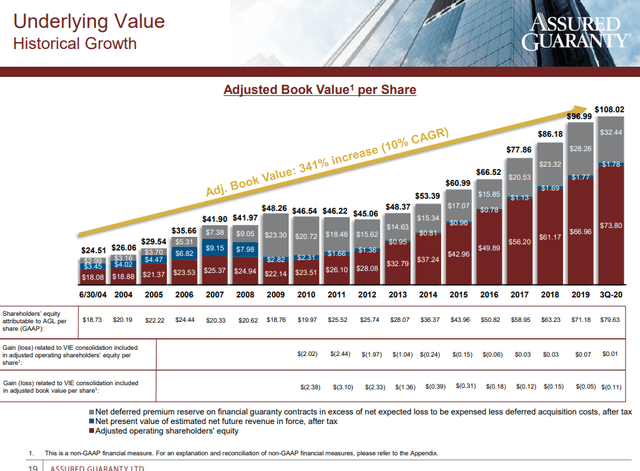

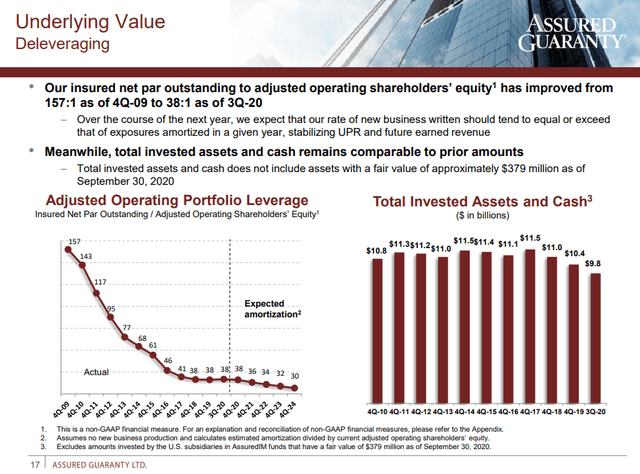

Assured Guaranty has written less new business production than has amortized over the last decade. This has resulted in a dramatic decrease in the insured operating portfolio leverage from 157 to 38. Total invested assets have hovered around $10 billion despite spending billions in stock buybacks and payments on Puerto Rico claims, which hasn’t paid any debt service on most obligations over the last 4 years. AGO has remained consistently profitable over the last 16 years on an operating basis, while most of its competitors have effectively been wiped out. Management has taken advantage of its improving capital position and discounted stock price, by buying stock back at massive discounts to intrinsic value. This has made AGO a compounding machine on all its key book value per share metrics, which are the best indicators of intrinsic value.

In the 3rd quarter of 2020, AGO earned $48MM of adjusted operating income, or $.58 per share. This consisted of $81MM of income from the insurance segment, a $12MM loss from the asset management segment, and an $18MM