While the world continues its hunt for yield, we continue to see interesting opportunities and abnormal risks more than ever. On one hand, we have funds that yield either nothing, or actually have negative yields. On the other hand, we have some good risk-reward opportunities. One area where we are finding bargains again and again is the preferred share sector. We had three good picks in this space recently. Those are solid picks, and we stand behind them. But what if someone does not want to do the dirty work themselves? Perhaps a fund would work for them. We looked across the spectrum of funds and tried to find one with low reasonable expenses. We did find one. Today, we examine Global X U.S. Preferred ETF (NYSEARCA:PFFD) and tell investors how this could fit in their portfolio.

The Fund

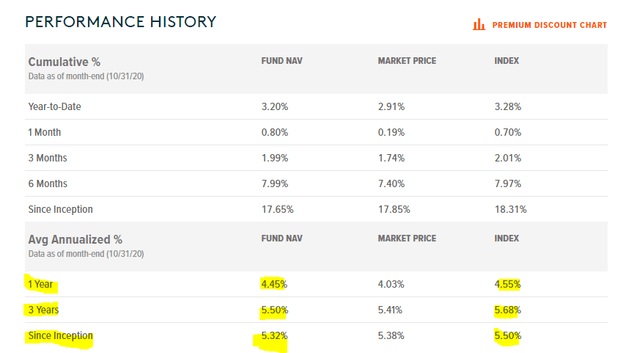

According to their website, the fund "invests in a broad basket of U.S. preferred stocks, providing benchmark-like exposure to the asset class." The fund was started about 3 years back and does not have a very long history. But it is delivering on what it stated it would. It has tracked its benchmark with an unusual zeal.

Source: Global X

Fees

The fund's slight underperformance versus its benchmark is rather impressive. At 18 basis points annually, the underperformance is even lower than the expense ratio.

Source: Global X

Benchmark indices don't have expenses so investors have to accept underperformance to at least the equivalent of expenses. With PFFD's underperformance coming in at 18 basis points annually, it actually did better than one would expect.

Distributions

PFFD belongs to a rare class of fund that strongly believes in paying out exactly what it earns. You can see the multiple small distribution reductions over time.

Source: Global X

This was likely driven by

Are you looking for Real Yields which reduce portfolio volatility and outperform in bear markets?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio. We are offering the next 20 subscribers a 20% discount to try our method risk-free!