Industrial commodities have been displaying lots of strength over the past weeks and months. On November 16, copper reached the highest price since June 2018 when the red metal reached $3.2625 per pound. Copper is often a bellwether metal that diagnoses the health and wellbeing of the global economy. Crude oil, which fell to a negative price on WTI futures and the lowest level in two decades on Brent futures, recovered to the $40 per barrel level in June. The price dropped in late October and reached an over five-month low on November 2 when it fell to $33.64 on the December NYMEX futures contract. The price put in a bullish reversal on that day and was back above the $40 level by November 9, where it has remained. Copper and petroleum are industrial commodities. They are highly liquid markets that attract speculators, producers, consumers, and other market participants as volume and open interest are at levels that support trading.

Lumber is also an industrial commodity as it is a construction requirement. While I watch the lumber market’s price action, I would never dip a toe in the futures market as I do in the copper and oil arenas. The volume and open interest are far too low to allow for easy execution of trades. However, lumber’s price action can be significant as it reflects the demand for a primary building material. The CatchMark Timber Trust (CTT) moves higher and lower with lumber’s price as it owns timberlands. Owning CTT is as good as owning wood.

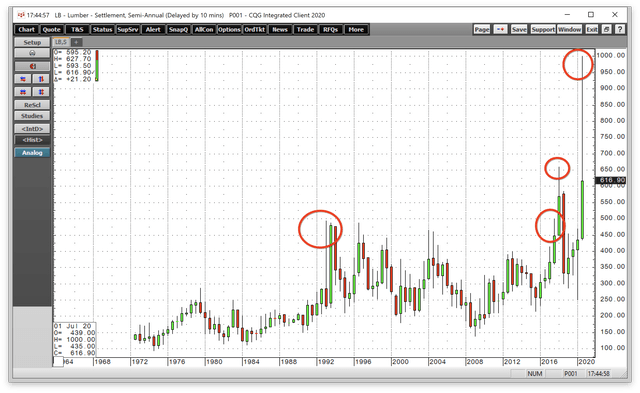

Volatile lumber moves back to the $600 level

In 1993, lumber rose to an all-time high of $493.50 per 1,000 board feet, a record that stood for twenty-four years until 2017 when the nearby futures price rose to $500.

Source: CQG

The semi-annual chart

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in both commodities and precious metals. My weekly report covers the market movements of over 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders.