Four Corners Property Trust (NYSE:FCPT) has seen quite the rebound, with its share price rising by 29% over the past six months. While no one likes to pay too much for a stock, I see the current valuation as being warranted for this resilient net lease landlord. In this article, I evaluate what makes FCPT a continued sound investment for long-term investors, so let’s get started.

(Source: Company website)

A Look Into FCPT

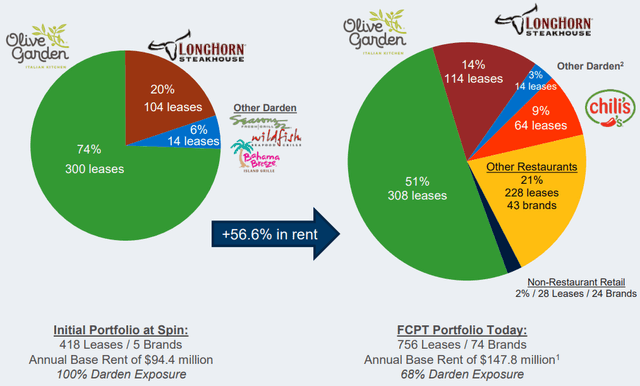

Four Corners Property Trust is a net lease REIT that is focused on owning and acquiring well-located properties that are leased to leading restaurant brands. The company was originally spun out from Darden Restaurants (DRI) with an initial portfolio of 418 restaurants, which was principally represented by Olive Garden and LongHorn Steakhouse. As of November, 2020, the company holds 756 properties, representing 74 restaurant brands in 46 states, with a weighted average lease term of 10.5 years.

One of the risks to FCPT is its heavy exposure to Darden Restaurants. As of September 30th, 68% of FCPT’s ABR (average base rent) is tied to Darden. However, if share price performance is of any indication, it seems that Darden is doing just fine. Over the past six months, Darden’s share price has risen by 38%, with a forward P/E ratio of 26.2. As such, it seems that the market is rather bullish on Darden’s prospects.

(Source: November Investor Presentation)

As seen above, FCPT has made big strides in diversifying its portfolio. Since inception, FCPT has diversified its Olive Garden exposure from 74% to 51% at present. Plus, I don’t see signs of FCPT slowing down. During Q3, FCPT acquired 18 properties for a combined purchase price of $48 million, at an initial weighted average cash yield of 6.3%, and a weighted average remaining lease term of 9 years. This was amply funded through an ATM (at-the-market) issuance of 2.4 million shares of common