As mentioned in a previous article, I wanted to explore income-generating REITs to add more cash flow into my portfolio. With a vaccine for COVID hopefully coming soon in the near future, I wanted to explore REITs that have not recovered to pre-pandemic highs. One such REIT is Kilroy Realty (NYSE:KRC).

Business Analysis

Just a brief background on the company, Kilroy Realty is a REIT focused on office properties in the California and Seattle area. The company also has some retail and residential properties. In terms of revenue, the office segment is by far the largest making up 94.2% of 2020 YTD revenue. As of September 2020, the company had 114 Class A office properties which translated to about 14.3 million rentable square feet. The company’s properties are located in LA, San Diego, San Francisco, and Seattle.

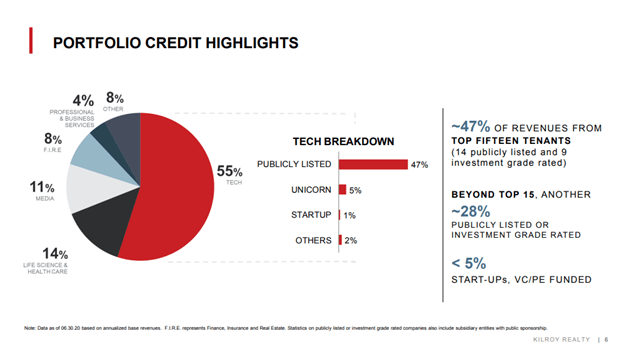

When examining office REITs, I typically like to look at the company’s tenant mix to get a better idea of the risk levels of their revenue. Not surprisingly given the company’s geographical location, Kilroy’s tenants are mostly in the technology industry at 55% of revenue. The second and third largest industry on Kilroy Realty’s portfolio is the Life Sciences and Media industry at 14% and 11% of annualized revenue respectively. Among the company’s tech clients 47% are publicly traded signaling the company tends to attract more mature/ stable tech firms as tenants. In fact, tenants that are start-ups or VC funded make up less than 5% of annualized 2020 revenue.

The company’s top five tenants are Dropbox (DBX), GM Cruise (GM), LinkedIn (MFST), Adobe (ADBE), and Salesforce (CRM). These firms make up 7.8%, 5.1%, 4.2%, 3.9% and 3.4% of annualized revenue for 2020 respectively. The company’s top 15 clients make up about 48% of the firm’s annualized 2020 revenue