IDACORP, Inc. (NYSE:IDA) is the main electric utility operating in the state of Idaho. I became interested in IDACORP because it meets practically all the criteria I look for in utilities, especially those utilities of a smaller size.

Some things I look at when considering a utility investment:

- The playing field. Is the state it serves growing its population? Does it have growing cities and are these attracting people? How affordable are these cities? Are state finances healthy?

- The business and its customers. Who are the clients? Is there a balance between commercial, industrial and residential? Where is the growth in demand coming from?

- Regulator and financial performance. Is the regulatory environment positive? Have past regulatory actions supported growth in assets and shareholder returns?

Idaho State

The State and its main city Boise are consistently growing population. Idaho is consistently among the top three positions for population growth. Obviously, this is not a crowded part of the country; its population today stands at less than 2 million people.

The State finances are healthy. Very recently, Fitch affirmed the state's AA+ rating, citing the following:

“Idaho's economy returned to strong growth following the last recession. State population increased by about 14% from 2010 to 2019, a slower rate than 2000 to 2010 (21.1%), but still exceeding by far the comparable national rate (about 6%)”

All of this is important because it is very difficult for a utility to grow its asset base and earnings where population is stagnant or shrinking. Growing population and especially growing cities present a wonderful tailwind to all businesses including the utilities that serve the area.

The business of IDACORP and its customers

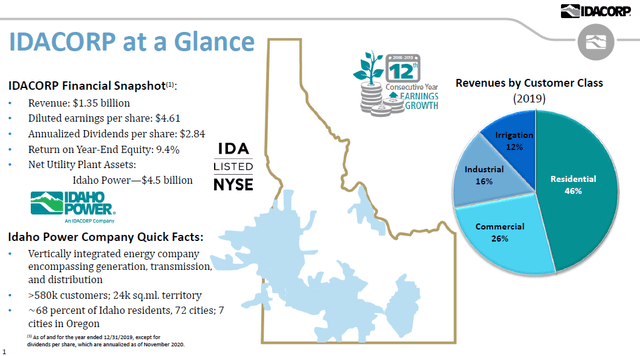

The following is the company snapshot from its latest investor presentation:

Source: Company investor presentation

Again, this is not a large utility. Its peak demand