Investment Thesis

Sumo Logic (SUMO) is a big data platform. By my estimates, it's likely to grow into fiscal 2022 at roughly 30% y/y, which is would be a marked deceleration from its recent trajectory but this estimate affords shareholders a margin of safety.

If Sumo Logic reaches $272 million by January 2022 (its year-end, fiscal 2022), a fairly conservative estimate, this puts its stock trading for less than 8x forward sales.

Not only is this cheaply valued in absolute terms, but it is a meaningful discount to its bigger peer, Splunk (SPLK). This investment is worthwhile considering. Here's why:

What is Sumo Logic?

Sumo Logic names itself a Continuous Intelligence Platform. As machines create an ever-increasing amount of data, from apps, IoT, cloud, and everything in between, there's an overabundance of data.

This makes it very difficult for businesses to go through the data manually, analyze it, ingest, and ultimately respond to the data in a timely fashion.

This is where Sumo Logic steps in. On the back of the theme that in the ''new normal' post-COVID world has accelerated its digitalization, Sumo Logic is a backend infrastructure software that monitors and troubleshoots their applications. For companies that wish to innovate or die, Sumo Logic makes that transition easy.

It operates in the cloud and on-premise. Sumo Logic detects and resolves modern security threats and works with the data to gain visibility into customer behavior.

Put simply, Sumo Logic analyzes complex unstructured machine data and helps its users make timely decisions.

Unstable Revenue Growth Rates

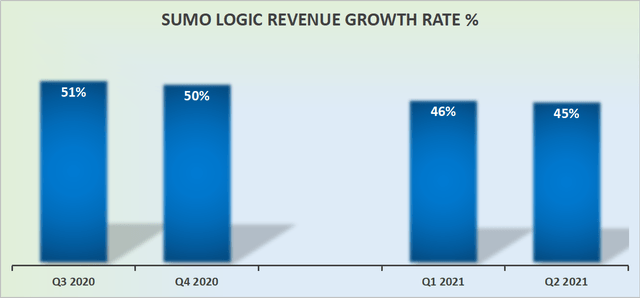

Source: author's calculations, SEC filings

For fiscal 2019 its revenues were up 53% y/y, while fiscal 2020 was up 50% y/y (data not shown).

However, more recently, as we can see above, there's been a slight tapering off in its growth rates. While fiscal Q3 2020 its revenue

Strong Investment Potential

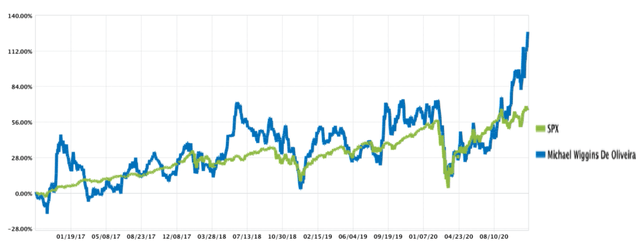

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive and profitable businesses.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Honest and reliable service.

- Hand-holding service provided.

- Very simply explained stock picks. Helping you get the most out of investing.

- Helpful advice together with videos.