Outfront Media’s (NYSE:OUT) stock has been a solid performer since the depths of the pandemic. I last visited the stock on July 21st, and had a bullish stance on it. Since then, the stock has posted a 32% return (as of writing), far outpacing the 11% return of the S&P 500 (SPY) over the same timeframe. Given the recent positive news on the vaccine, I remain optimistic on the company. In this article, I show what makes Outfront Media a worthy buy for long-term investors, so let’s get started.

(Source: Company website)

A Look Into Outfront Media

Outfront Media is an outdoor advertising company with 512K total displays in prime locations spread across North America. Its corporate model is governed by what it calls “TLC,” which stands for technology, location, and creativity. In 2019, its media displays reached 7 out of 10 Americans per week, equating to 16.6 billion weekly impressions across 70+ U.S. markets, and it’s likely that you have seen one of its billboards on your daily commute. Last year, Outfront generated nearly $1.8 billion in total revenue.

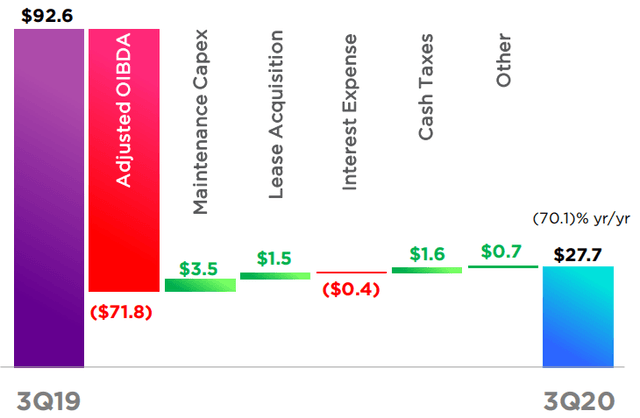

As one would expect, Outfront Media’s business has taken a significant hit this year due to decreased consumer mobility during this pandemic. This continues to be reflected in the latest quarter’s results, with revenue declining by 39% YoY, from $462.5M in Q3’19, to $282.3M in Q3’20. AFFO/share had a sharper 70% YoY decline, to $0.19 per share in the latest quarter. That’s because Outfront has to maintain a certain level of operating expense (maintenance & SG&A) that cannot be dialed down at the same rate as the decline of revenue.

As seen in the YoY AFFO bridge below, the decline in adjusted OIBDA (operating income before depreciation and amortization) was partially offset by improvements on the expense side.

(Source: Q3’20