Investment Thesis

Royalty Pharma (NASDAQ:RPRX) IPO'd in June, selling ~72m shares at a price of $28 per share, earning the company ~$1.9bn after underwriters discounts and fees were deducted.

This is a substantial raise for a biotech focused company - in fact it is more than three times the size of the largest ever pure biotech IPO - Moderna's - which raised ~$604.3m back in December 2018. But in actual fact Royalty acts more like a fund manager than a biopharmaceutical in terms of how it is set up and how it operates.

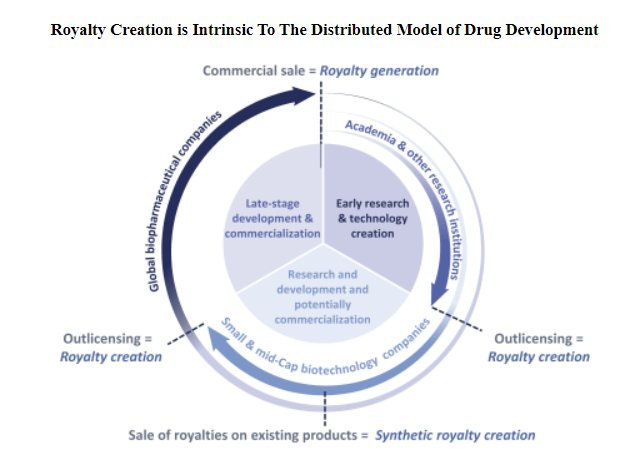

The company makes strategic acquisitions of royalty streams related to the drug development process. Typically, a biotech developing a new drug may partner with a large Pharma company, who will assume responsibility for the development, commercialisation and marketing of a promising drug candidate, investing much larger sums than the smaller biotech can, but also making milestone payments to the biotech as it hits development and commercialisation targets, and agreeing to give the biotech a portion - usually in the mid-teen percentages - of all future global sales, known as a royalty.

It is these royalty streams that Royalty - as its name suggests - then buys form the biotechs, in exchange for an up-front payment.

Extract from Royalty Pharma IPO prospectus describing how royalties work.

After being in existence since 1996, Royalty has taken the decision to go public, presumably to raise substantially more funds and increase its purchasing power. Besides its IPO funding, the company has issued ~$6bn of debt at a coupon of just 2.125% - substantially lower than the 3.19% average for the BioPharma sector - with a 12.3 year maturity (BioPharma median is 11.5 years).

Royalty is headquartered in the United Kingdom and has a highly complex ownership structure. Based on detail from SEC

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.