Over the past years, the United States became the world’s leading crude oil-producing nation, surpassing Saudi Arabi and Russia. In March 2020, daily output reached a record 13.1 million barrels per day. Meanwhile, discoveries of massive natural gas reserves in the Marcellus and Utica shale regions of the US contain quadrillions of cubic feet of gas.

For many decades, US energy policy sought independence from foreign oil. The gasoline shortages of the 1970s and fears of political instability in the Middle East, home to over half the world’s oil reserves, led to more US production. Technological advances in fracking to extract fossil fuels from the earth’s crust and regulatory reforms under the Trump administration led to independence. Rising US production kept a lid on prices and created sufficient supplies that prevented price spikes when the Middle East’s political temperature rose.

On January 20, 2021, former vice president Joe Biden will raise his hand, recite an oath, and become the forty-sixth President of the United States. President-elect Biden pledged a greener path for the US. Oil and gas production is likely to decline as the administration pursues alternative energy sources. The Invesco Global Clean Energy ETF product (NYSEARCA:PBD) holds shares in companies that are likely to appreciate with a greener environment.

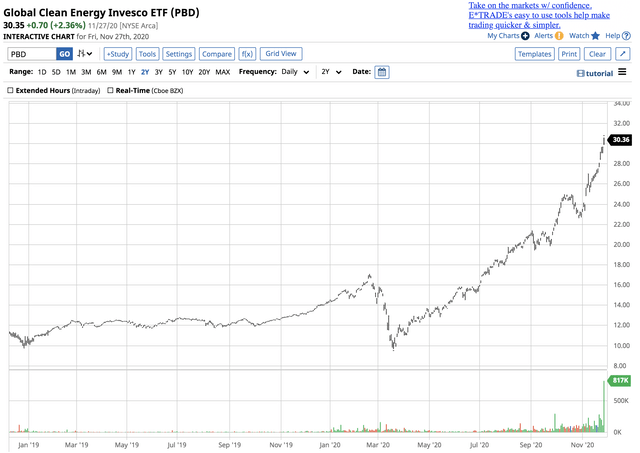

An impressive performance in PBD since late 2018

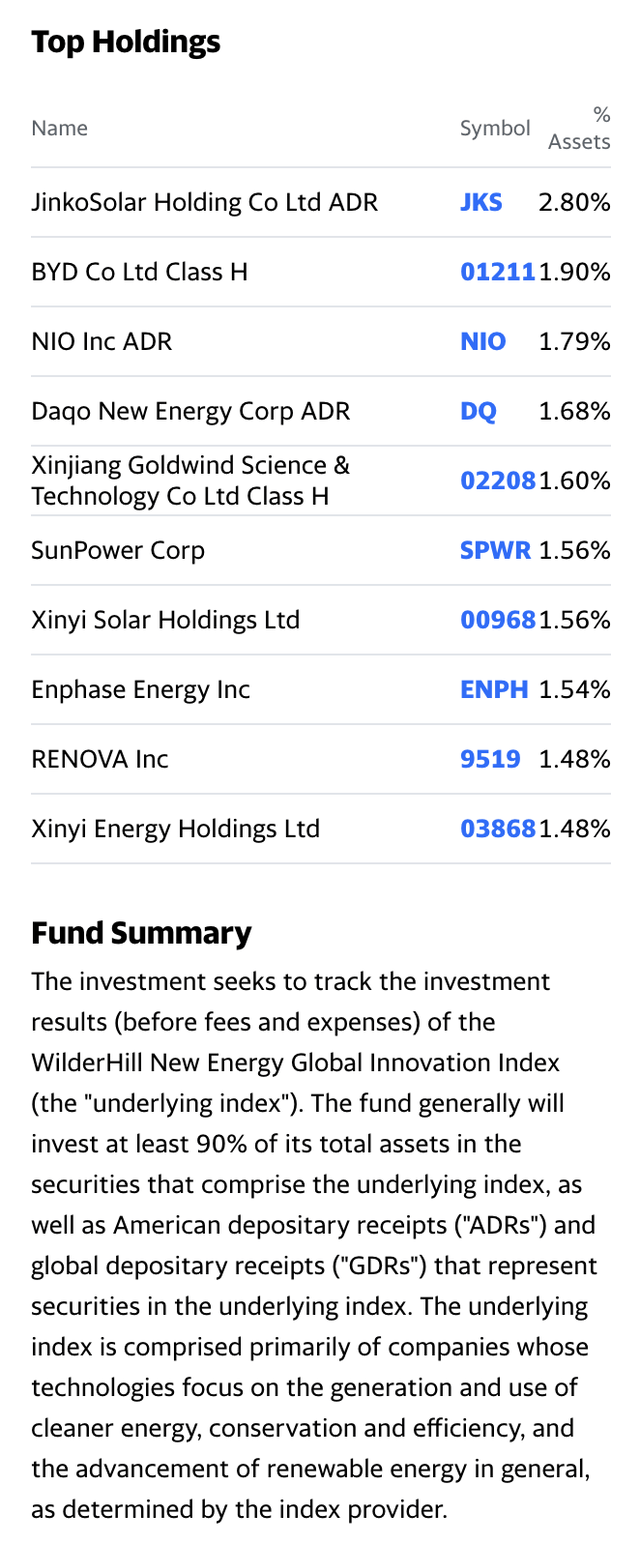

The top holdings and fund summary of the Invesco Global Clean Energy ETF (PBD) include:

Source: Yahoo Finance

PBD has net assets of $124.18 million, trades an average of 94,860 shares each day, and charges a 0.75% expense ratio. The ETF holds a portfolio of companies with clean and renewable energy companies around the world. After reaching a low of $9.75 in late 2018, the shares rose to a high of $17.10 in February 2020.

Source: Barchart

After a decline to a

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, foreign exchange, and precious metals. My weekly report covers the market movements of over 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders.