Thesis

DocuSign (NASDAQ:DOCU) has been a COVID beneficiary as investors realize that virtual signings have been accelerated. DocuSign relies on the real estate industry and a few other verticals for growth, and has expanded its product set to deepen workflows.

The stock has not enjoyed the same rally as other high growth software names and it is one of the best run software companies from a cost perspective. I recommend playing into the earnings print on Thursday via long stock and monthly call options. I believe the Company will beat expectations and guide above the Street based on new product launches, continued expansion in existing markets, and TAM expansion.

Source: DocuSign

Earnings

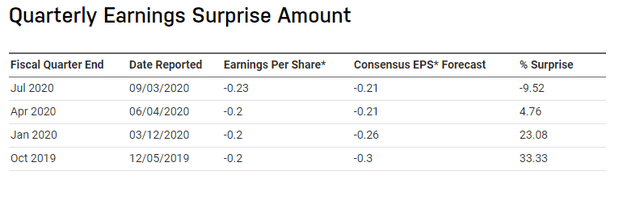

DocuSign reports on Thursday 12/3 after the close, which I believe presents a good opportunity to buy. Historically, the stock has outperformed expectations. The recent underperformance in the last quarter has weighed on the stock too much.

Source: Nasdaq

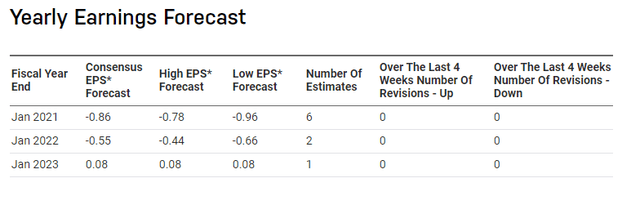

Further, looking at earnings revisions, the Company has held flat its forecasts over time with very few revisions. This presents an opportunity to have a view that is divergent from the Street.

Source: Nasdaq

Financials

DocuSign is a well run, balanced growth company that is benefitting from COVID. One of the core parts of the financial thesis here is that people will not go back to paper and pen signing once they have tried DocuSign. This will result in higher than expected upsell from free to paid, upsell within the tiers, and new product traction like notary and other premium workflow tools.

DocuSign is also pushing longer contracts and bigger terms to get more visibility. I believe the nature of the workflows will make this revenue driver productive. One of the key indicators here is getting more contracts over the 12 month mark and having subscription continue to be above 90%. This